Last week, my office hosted a panel discussion on the hot topic of homeowners insurance. In the wake of several natural disasters, supply chain issues, and inflation on building materials, homeowners insurance is currently experiencing a “hard market”. Non-renewal and cancellation rates are rising, some carriers are leaving certain states, and specific aspects of a home, like wood-shake roofs, are being more scrutinized. This has caused coverage to increase in cost and, in some cases, not be available. We assembled this panel to get this critical real-time information in front of our clients, so they can adequately care for their home(s).

As your trusted real estate advisor who helps you transact when it is time for a move, I also see it as my role to help you protect your asset through education. While I am not an insurance expert, the esteemed panel of insurance professionals we invited to discuss the state of the homeowners insurance market is an example of a trusted advisor in the homeowners insurance field. Below are my top takeaways from the hour-long guided discussion. You can also access the event recording below, which also includes 30 minutes of Q&A from the audience.

What is RCV (Replacement Cost Value), and why is it important?

RCV is the dollar amount established to determine the cost of rebuilding your home to its pre-damage condition. This is different from market value, which includes the land and location premiums. RCV estimates the cost of materials and labor to restore or rebuild your home at today’s prices. This number is critical, and that is why it is important to always let your carrier know when you have made changes or improvements to your home. NOTE: Some carriers use ACV (Actual Cost Value), but this is not preferred as it takes into account depreciation.

Request an annual review of your policy with your carrier.

Most carriers have some built-in annual coverage adjustments, but they are often insufficient. The homeowner is responsible for reporting upgrades, additions, and improvements to their carrier so the increase in investment translates to coverage. Record-keeping of invoices and receipts helps establish accurate replacement value. Notifying your carrier of these changes will capture the appropriate coverage.

Request and review the Declaration Page in your policy.

The declaration page in your policy provides a detailed overview of your coverage. It lists what is covered, the RCV, notes additional riders, and outlines your premiums and deductibles. This is a valuable tool for helping you understand your policy and ensure that everything you have done to your home is included. You can easily request this from your carrier, and it should lead the discussion at your annual review.

Coverage vs. cost matters!

Carriers often advertise and try to appeal to customers based on the affordability of their rates. While no one wants to overpay for insurance, you must analyze the cost-benefit of adequate and complete coverage over the cheapest policy. Oftentimes, the cheapest premiums will lead to your home being underinsured.

Consider adding specific riders for additional coverage.

Unfortunately, earthquake and water backup riders are not included in your basic policy. However, you can purchase these specific riders to add them to your policy and be covered should damage be caused by an earthquake or your sewer line backing up into your home and causing a flood. Adding riders for personal property, such as fine jewelry, is common. These will be listed on your declaration page for an easy accounting of your coverage. Make sure you ask your insurance professional what other rider options are available, so you don’t miss something you would like covered.

Align your deductible with your claim tolerance.

You want to analyze at what point you would make a claim if something happened to your home. The theory of only making a claim if the repair or replacement amount is catastrophic is a good rule of thumb to ensure your policy is not dropped, non-renewed, or wildly increased in premium. What is catastrophic for one person may not be for another, so it is a personal preference around your financial comfort. What you don’t want to have happen is to make a claim on something you could handle on your own, and then have something big happen and no longer be covered. Always consult your insurance professional off-the-record before contacting the carrier directly, so your decision-making is not misconstrued as a claims risk.

Maintain your home to protect your premium.

Due to the industry’s tight margins, many carriers are visiting properties and performing drive-by and/or drone inspections to help determine their risk exposure. They are also accessing Google Earth to make these determinations. Homes that do not appear well-maintained are penalized with premium increases and sometimes dropped by their carriers. This is also why opening and reading all mail from your insurance carrier is essential.

The home and the human are considered in the coverage.

The home’s condition will play into the coverage and premiums, as will the human who is purchasing the policy. Carriers will examine a person’s claims history to help determine their risk exposure. It is common to look back 36 months, and if a person has multiple claims in that timeframe, they will have higher premiums and, in some cases, not be able to purchase coverage.

Have a good relationship with your insurance professional.

Whether working with an insurance broker or a captive company, having a consistent relationship with your provider is valuable. They should be available to answer questions, help you decide whether to make a claim, and review your policy and riders annually. You should never call the carrier directly without first contacting your insurance professional. They can help you navigate important decisions that will keep your coverage intact and your premiums manageable.

I hope you found this information useful—I know I did! It drove home my responsibility of managing my policy and ensuring I am adequately insured through communication with my insurance professional. Much like real estate, having a trusted advisor regarding homeowners insurance is crucial. After all, our home is often our largest asset and most prized possession. Protecting it is critical! Click HERE to access the recording (Passcode: E+gmk9V*) to watch the panel discussion.

As always, please don’t hesitate to reach out if you have any questions or concerns about your property, and I can help guide you to the right answers. I have reputable referrals to multiple insurance professionals that can help you should you need additional contacts. My goal is always to help keep my clients informed and empower them to make strong decisions.

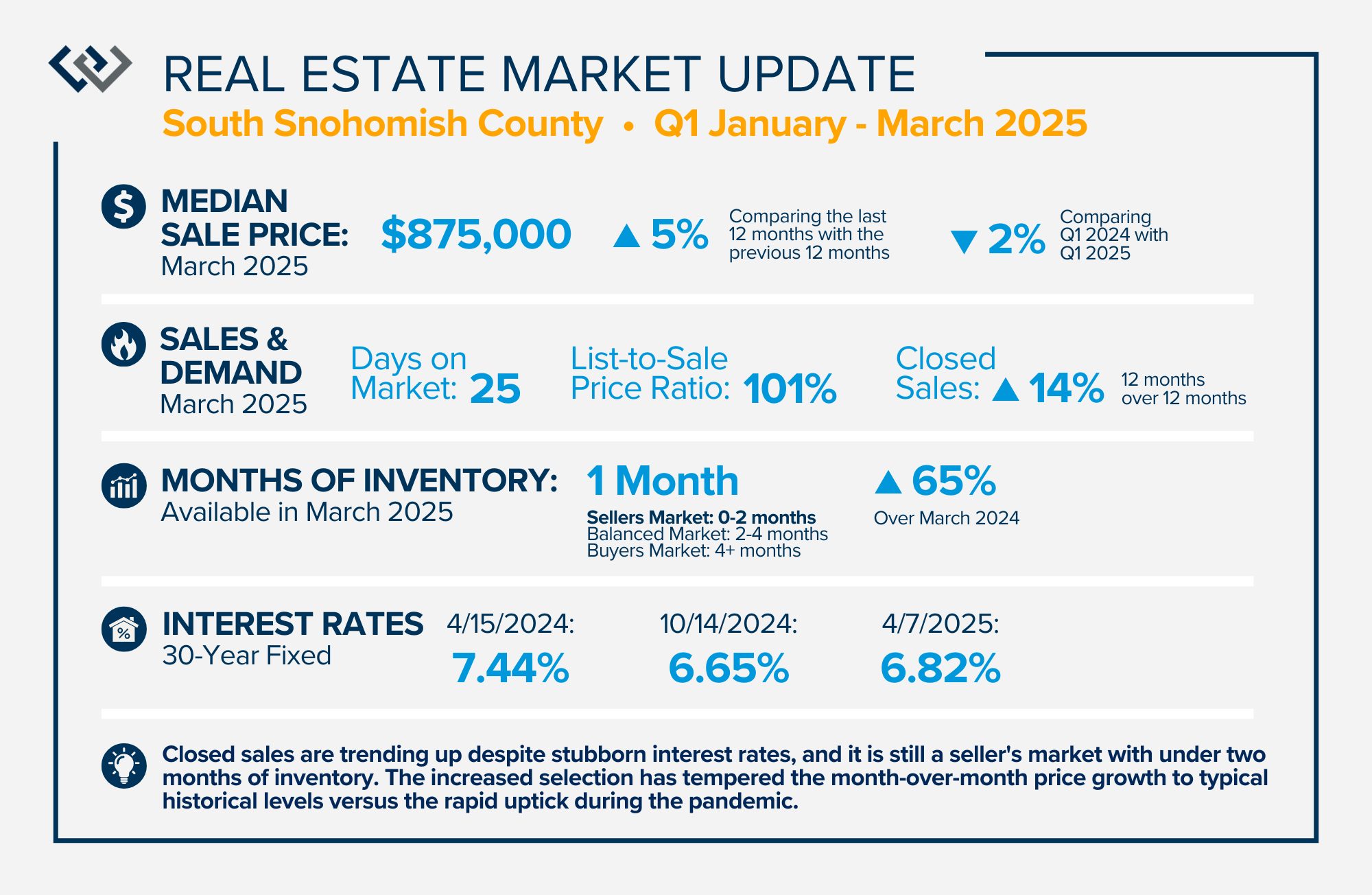

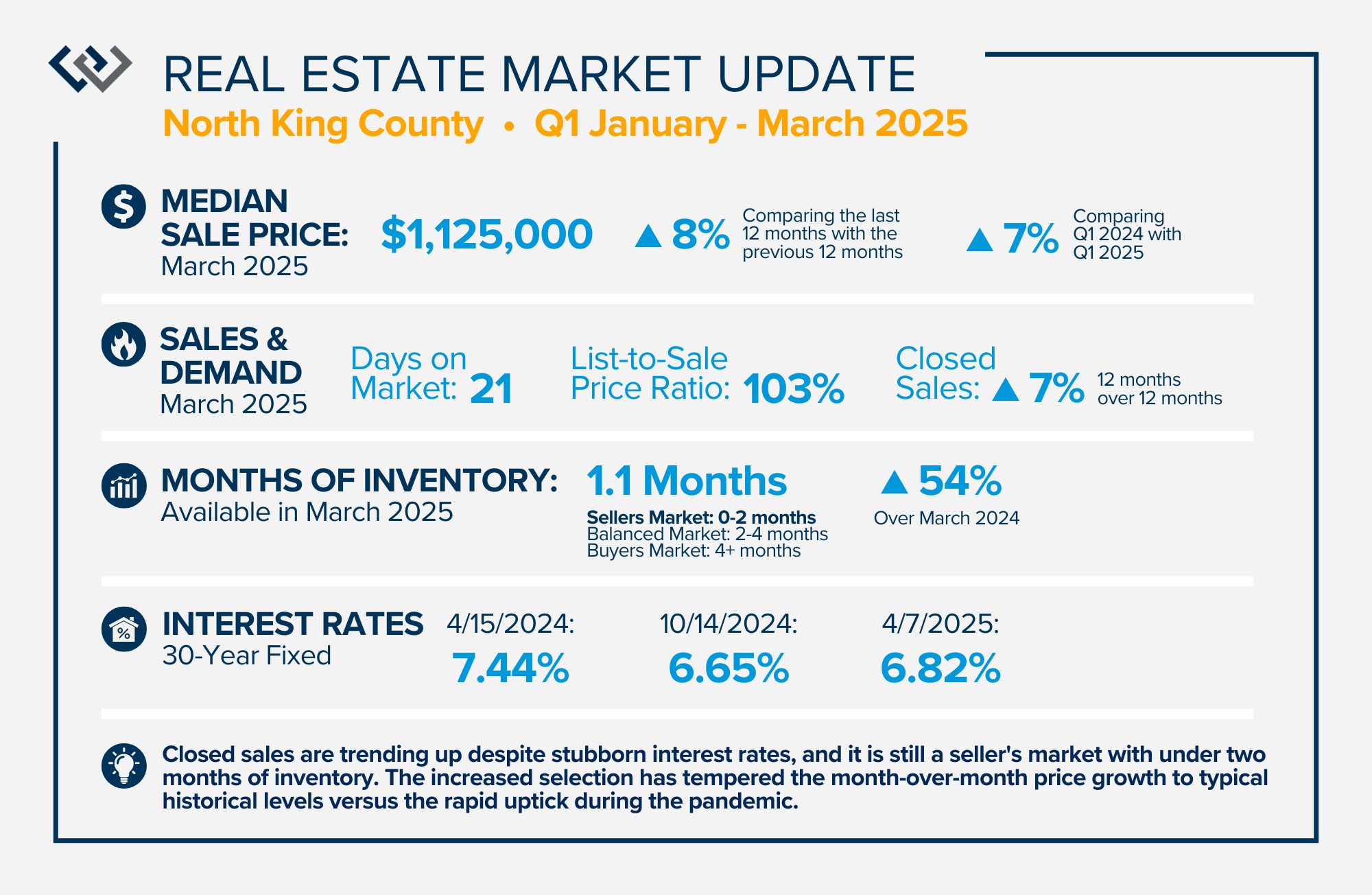

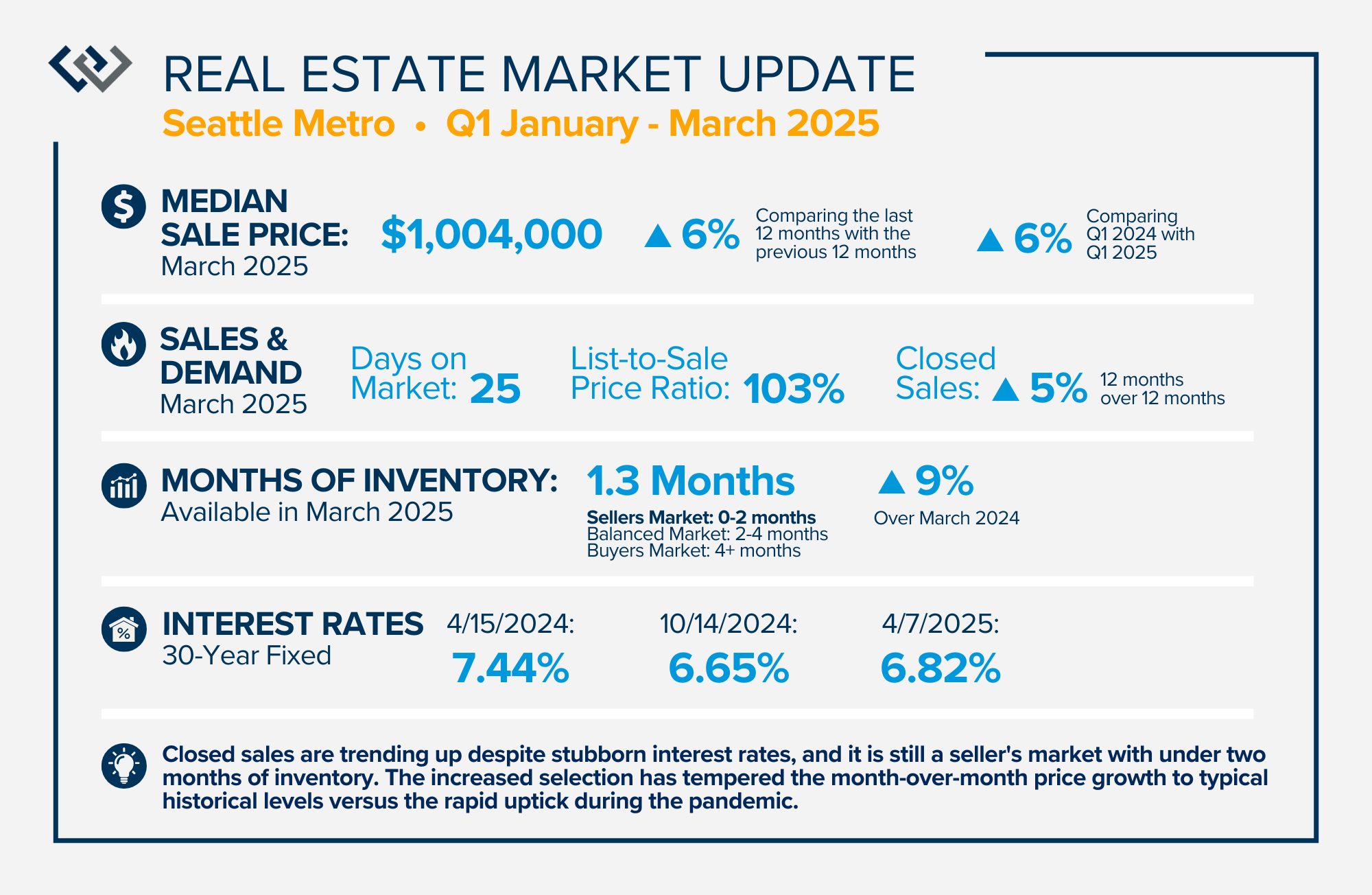

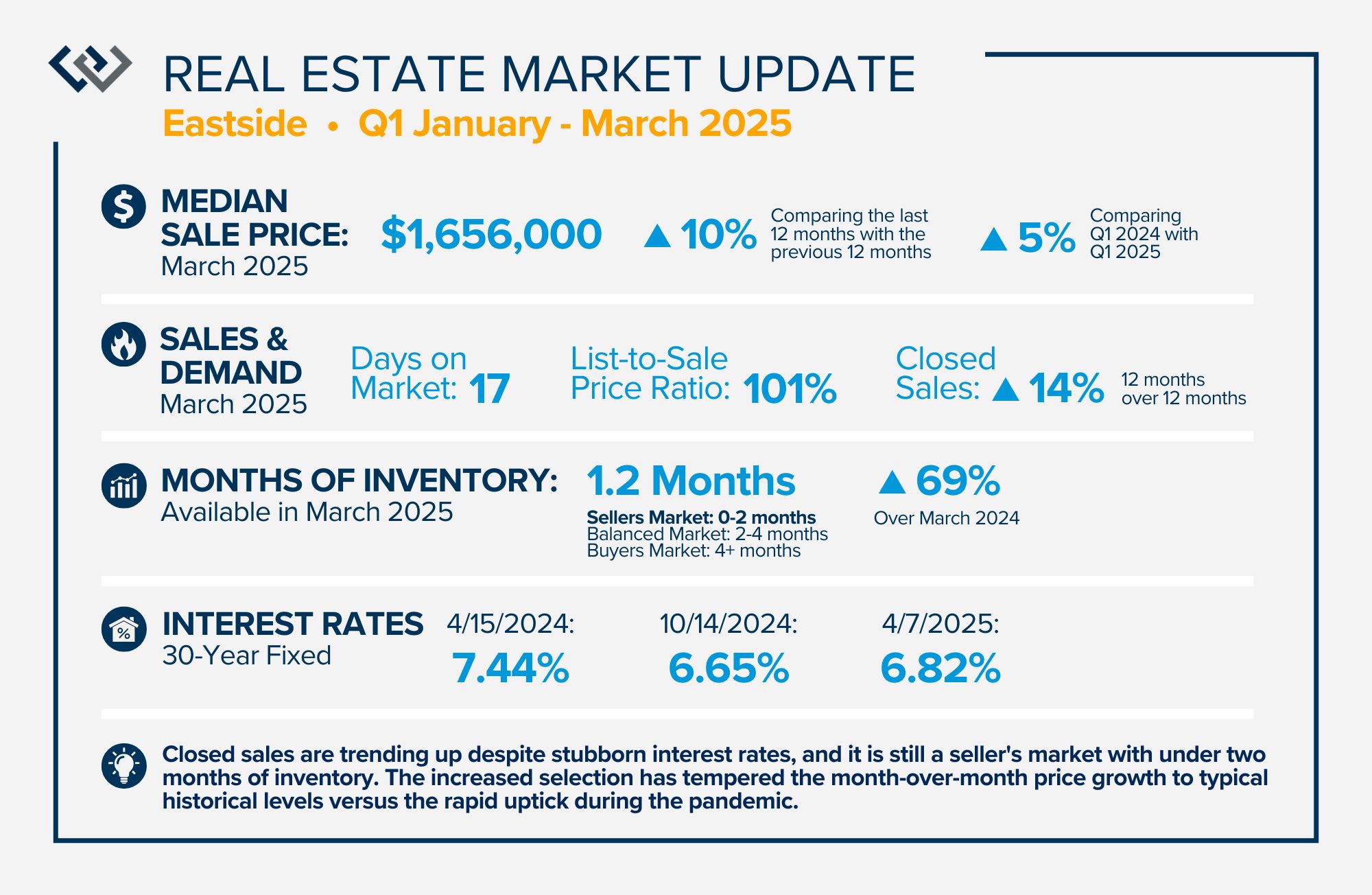

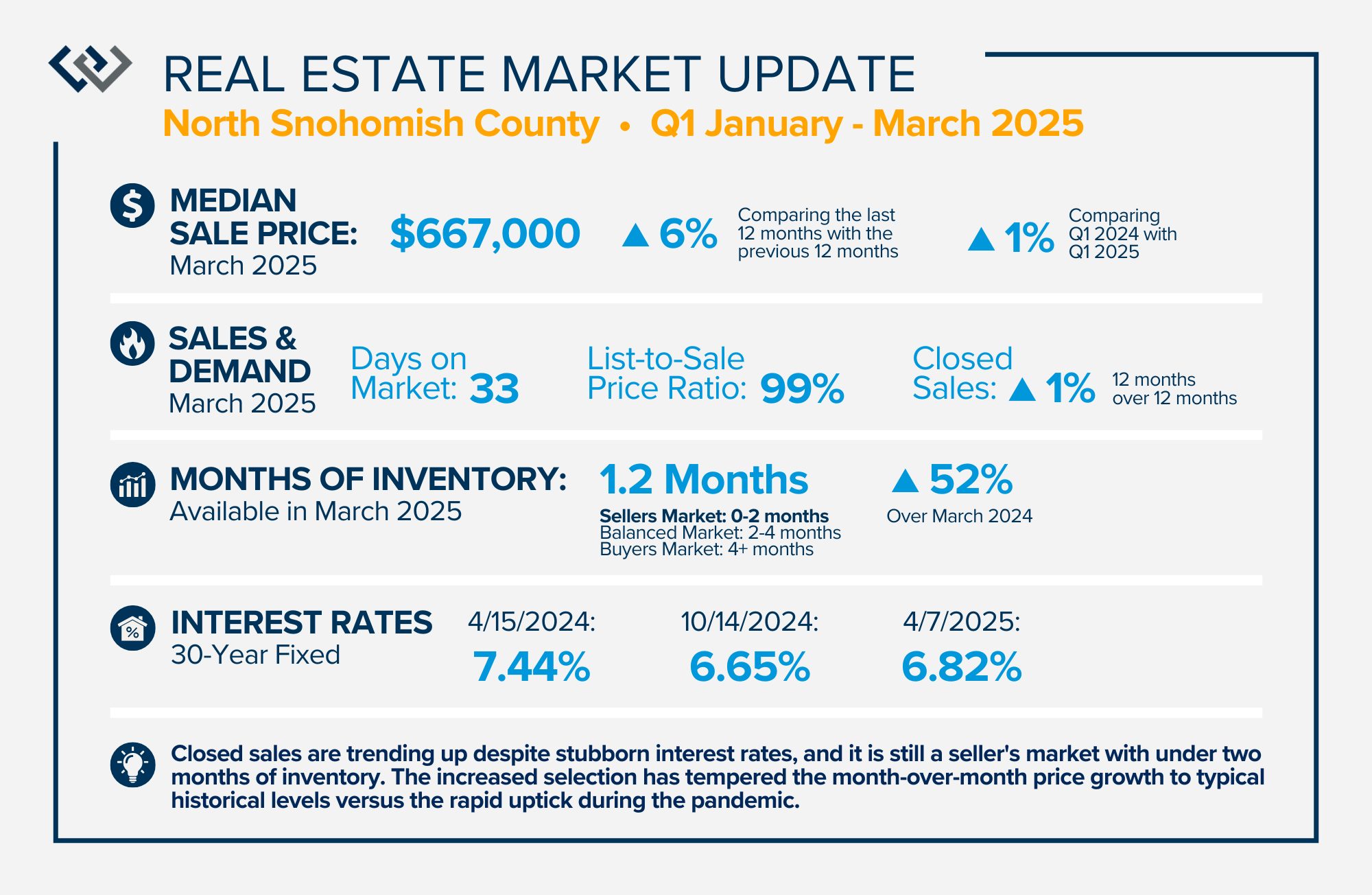

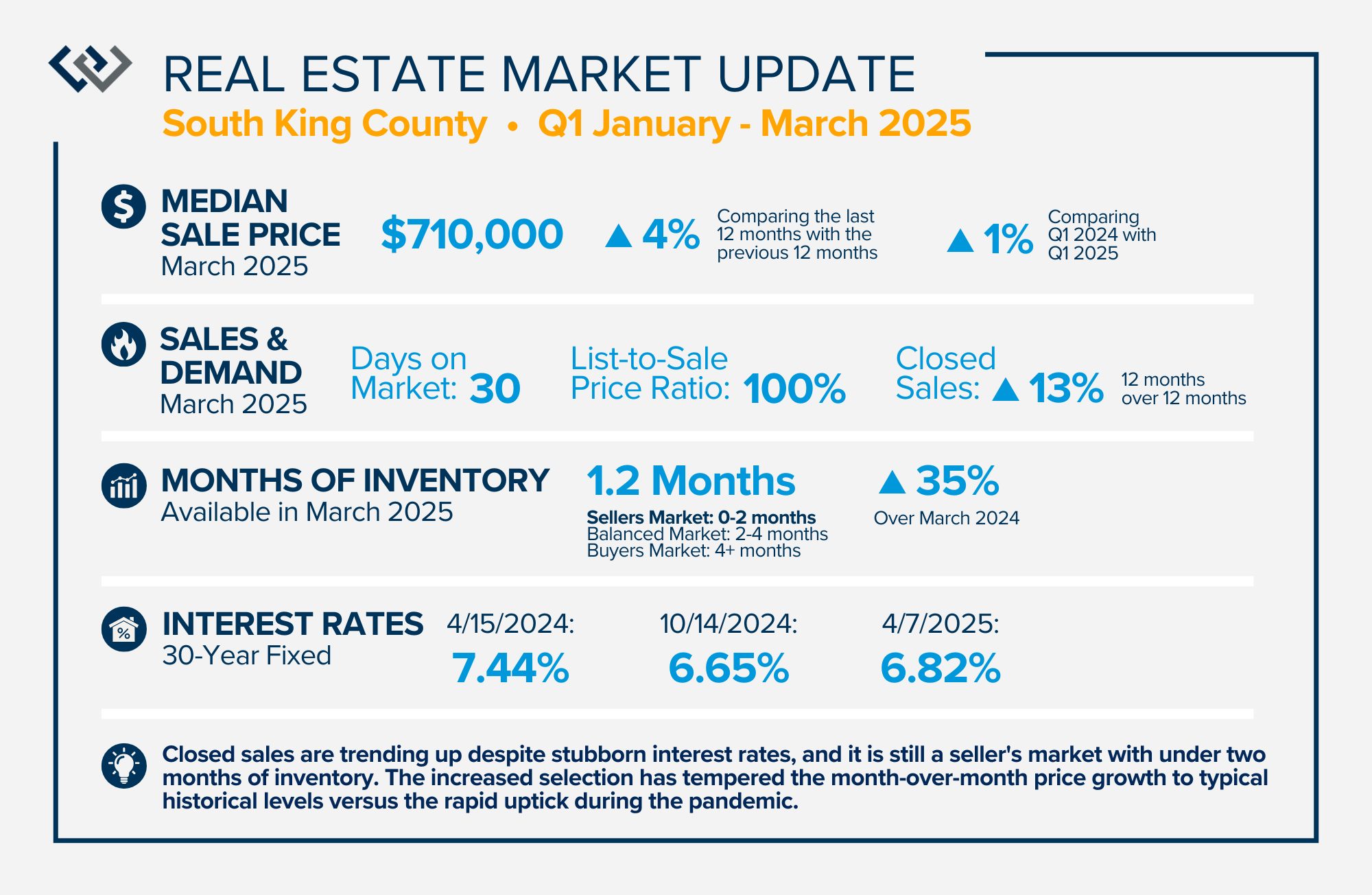

, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

y, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

y, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

ory, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

ory, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

ket with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

ket with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.

, this has been a welcome relief for buyers. Closed sales are trending up despite stubborn interest rates, and it is still a seller’s market with under two months of inventory. The increased selection has tempered the month-over-month price growth to typical historical levels versus the rapid uptick during the pandemic. Interest rates have decreased since last year and are expected to recede slowly throughout the year.