Nothing feels more like fall than pumpkin picking, hay rides and corn mazes. Get your latte in hand and head out to any one of these great, local farms to have some harvest fun and find that perfect jack-o-lantern to light up your porch.

Times, dates & activities may change, please use the provided links to confirm details and hours of operation.

KING COUNTY

Baxter Barn

31929 SE 44th St, Fall City

Pumpkin patch, tractor-pulled hay rides, fresh eggs, gift shop, pony rides, picnic area, farm animals

Carpinito Brothers

1148 Central Ave N, Kent

Pumpkin patch, corn maze, farm fun yard, hay rides, produce stand, concessions

Fall City Farms

3636 Neal Road, Fall City

Pumpkin patch, tractor-pulled hay rides, fresh honey, pre-picked produce, farm animals, snacks and refreshments.

Fox Hollow Family Farm

12031 Issaquah Hobart Rd SE, Issaquah

Pumpkins for sale, hay bale maze, bouncy house, face painting, haunted house, pony rides, petting zoo, farm animals, concessions

Jubilee Farm

229 W Snoqualmie River Rd NE, Carnation

Pumpkins, horse-drawn covered wagon rides, hay rides, hay bale maze

Oxbow Farm

10819 Carnation-Duvall Rd NE, Carnation

Pumpkins, produce, picnic area, playground

Mosby Farm Pumpkin Patch

12747-b South East Green Valley Rd, Auburn

Pumpkin patch, corn maze, tractor-pulled hay rides, snacks and refreshment stand, picnic area

The Nursery at Mt Si

42328 SE 108th St, North Bend

Pumpkin patch, tractor-pulled hay rides

Remlinger Farms

32610 NE 32nd St, Carnation

Pumpkin patch, corn maze, animal barnyard, pony rides, steam train, hay jump

Serres Farm

20306 NE 50th St, Redmond

Pumpkin patch, corn maze, duck races, animal train

Thomasson Family Farm

38223 236th Ave SE, Enumclaw

Pumpkin patch, corn maze, kids korral, tractor train rides, pumpkin sling shot

Tonnemaker Valley Farm, Woodinville Farm Stand

16215 140th Pl NE, Woodinville

You-pick pumpkin patch, you-pick flowers, produce stand, on-site pepper roasting on Saturdays

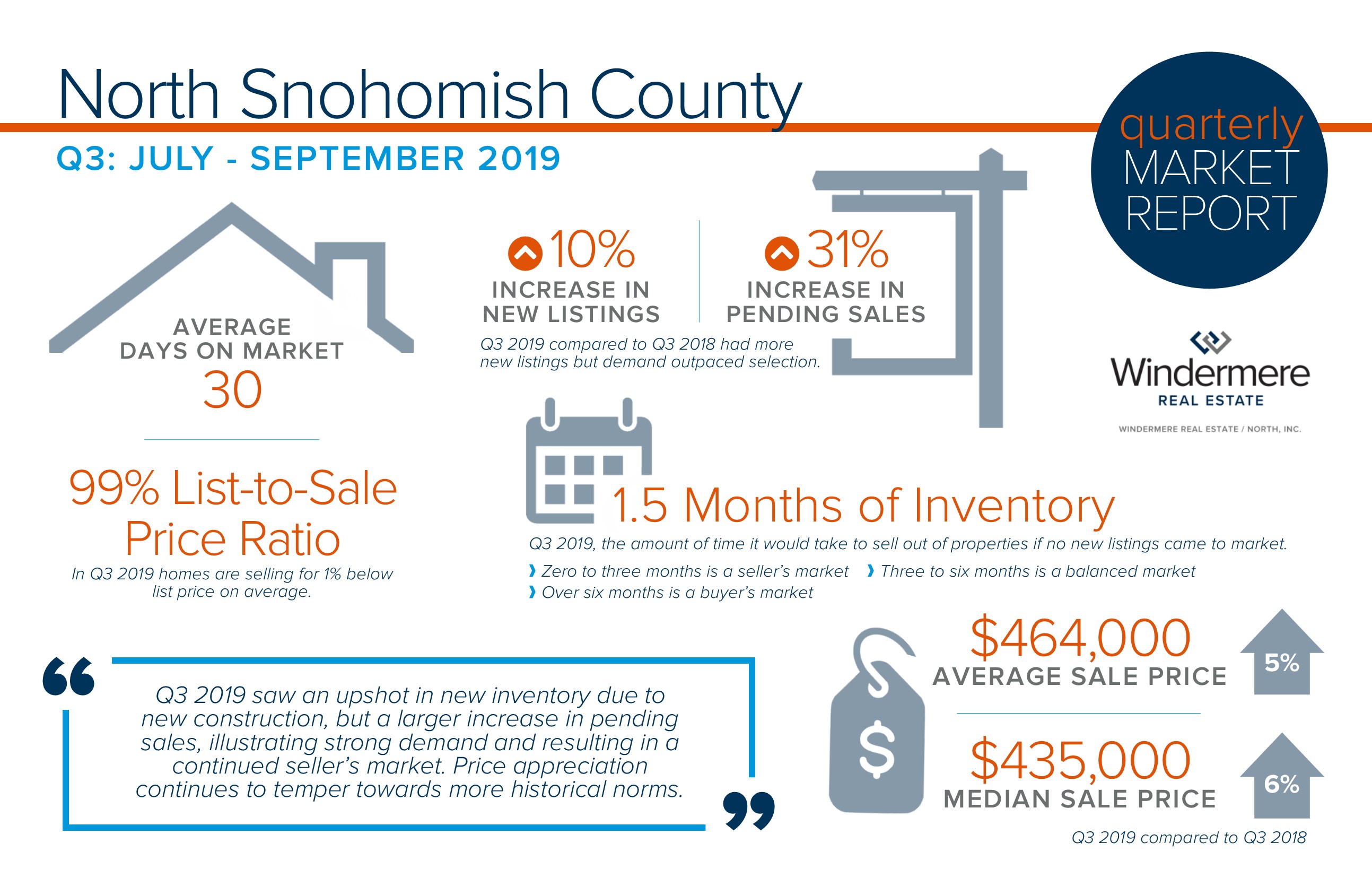

SNOHOMISH COUNTY

Biringer’s Black Crow Pumpkins & Corn Maze

2431 Highway 530 NE, Arlington

Pumpkin patch, corn maze, straw or hay bale maze, tractor-pulled hay rides, farm market, picnic area

Bob’s Corn & Pumpkin Farm

10917 Elliott Rd, Snohomish

Pumpkin patch, corn maze, bonfire & picnic area, hay rides, pony rides, playground, concessions

Carleton Farm

630 Sunnyside Blvd SE, Lake Stevens

Pumpkin patch, train rides, corn maze, haunted corn maze, tractor-pulled hay rides, farm animals, farm market

Craven Farm

13817 Short School Rd, Snohomish

Pumpkin patch, corn maze, tractor-pulled hay rides, face painting, farm animals, snacks & refreshment stand

The Farm at Swans Trail

7301 Rivershore Rd, Snohomish

Pumpkin patch, corn maze, pick your own apples, pig & duck races, petting zoo, putt-putt golf and more

Fairbank Animal Farm & Pumpkin Patch

15308 52nd Ave W, Edmonds

Pumpkins, petting zoo, farm animals, picnic area

Fosters Pumpkin Farm

5818 State Route 530 NE, Arlington

Pumpkin patch, corn maze, hay bale maze, corn cannon, pre-picked produce, face painting, farm animals, snacks and refreshment stand, picnic area

Stocker Farms

8705 Marsh Rd, Snohomish

Pumpkin patch, corn maze, haunted corn maze, tractor-pulled hay rides, jumping pillow and more

Thomas Family Farm

9010 Marsh Road, Snohomish

Pumpkin patch, corn maze, monster truck rides, haunted house, gem mining, Zombie Safari Paintball Hayride, beer garden, putt-putt golf and more

PIERCE COUNTY

Double R Farms

5820 44th St E, Puyallup

Pumpkin patch, corn maze, hay rides, farm animals, pumpkin sling shot

Maris Farms

25001 Sumner-Buckley Hwy, Buckley

Pumpkin patch, corn maze, haunted woods, farm animals, hay ride, trout fishing, play ground

Picha’s Farm

6502 52nd St E, Puyallup

Pumpkin patch, corn maze, hay ride, pumpkin sling shot, concessions

Scholz Farm

12920 162nd Ave E, Orting

Pumpkin patch, corn maze, play area

Spooner Farms

9622 SR 162 E, Puyallup

Pumpkin patch, farm animals, face painting, pumpkin sling shot, concessions

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

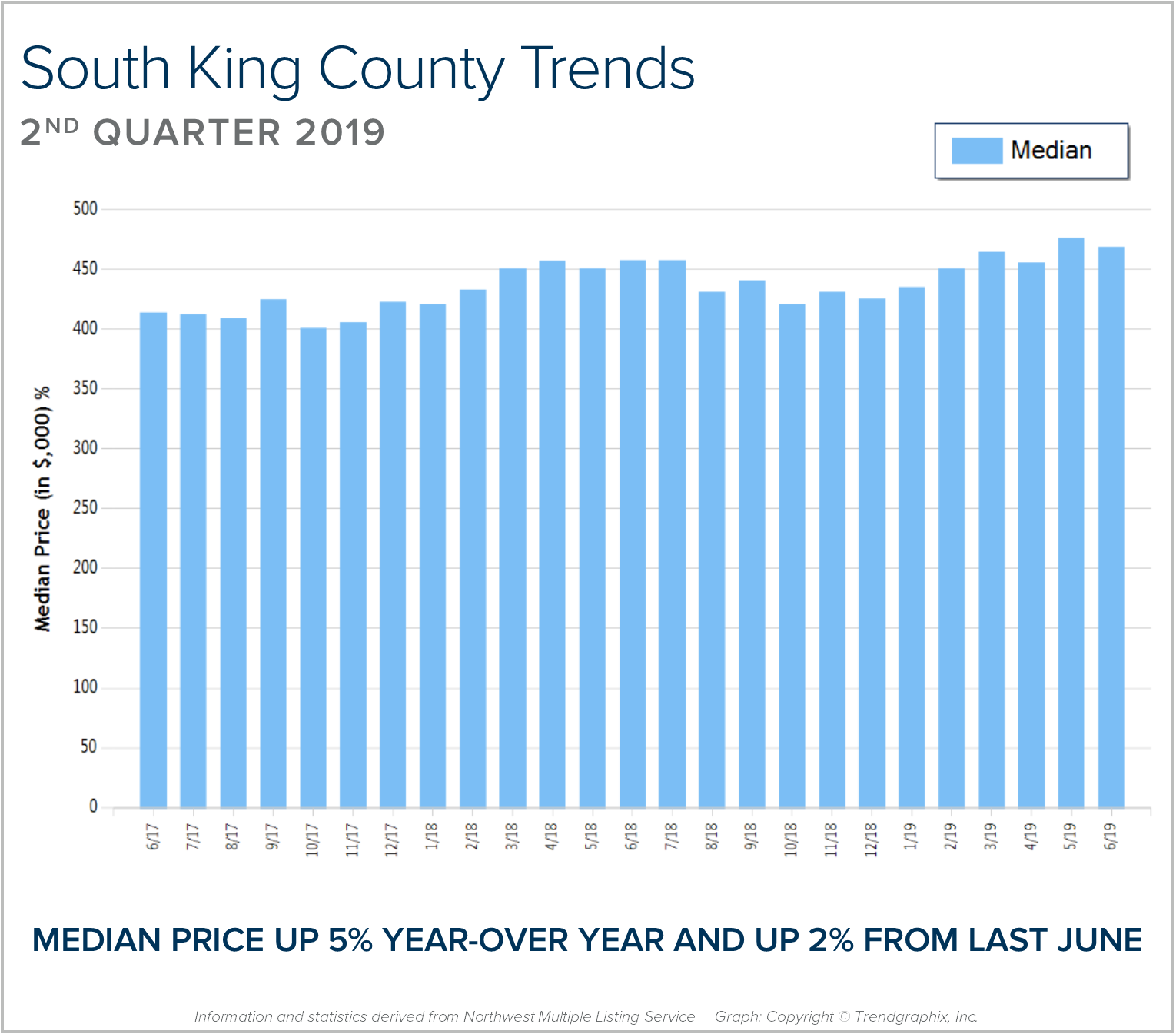

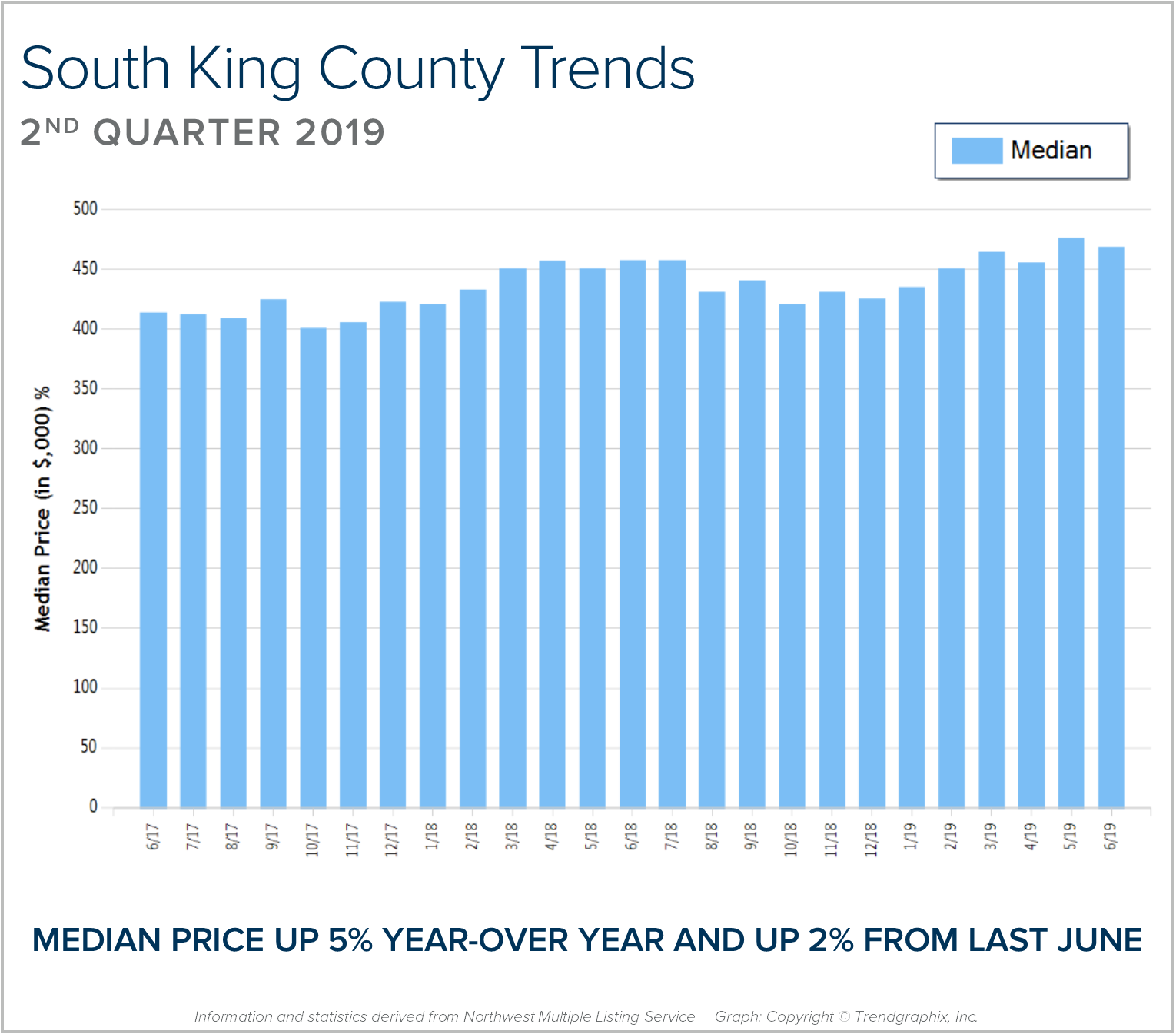

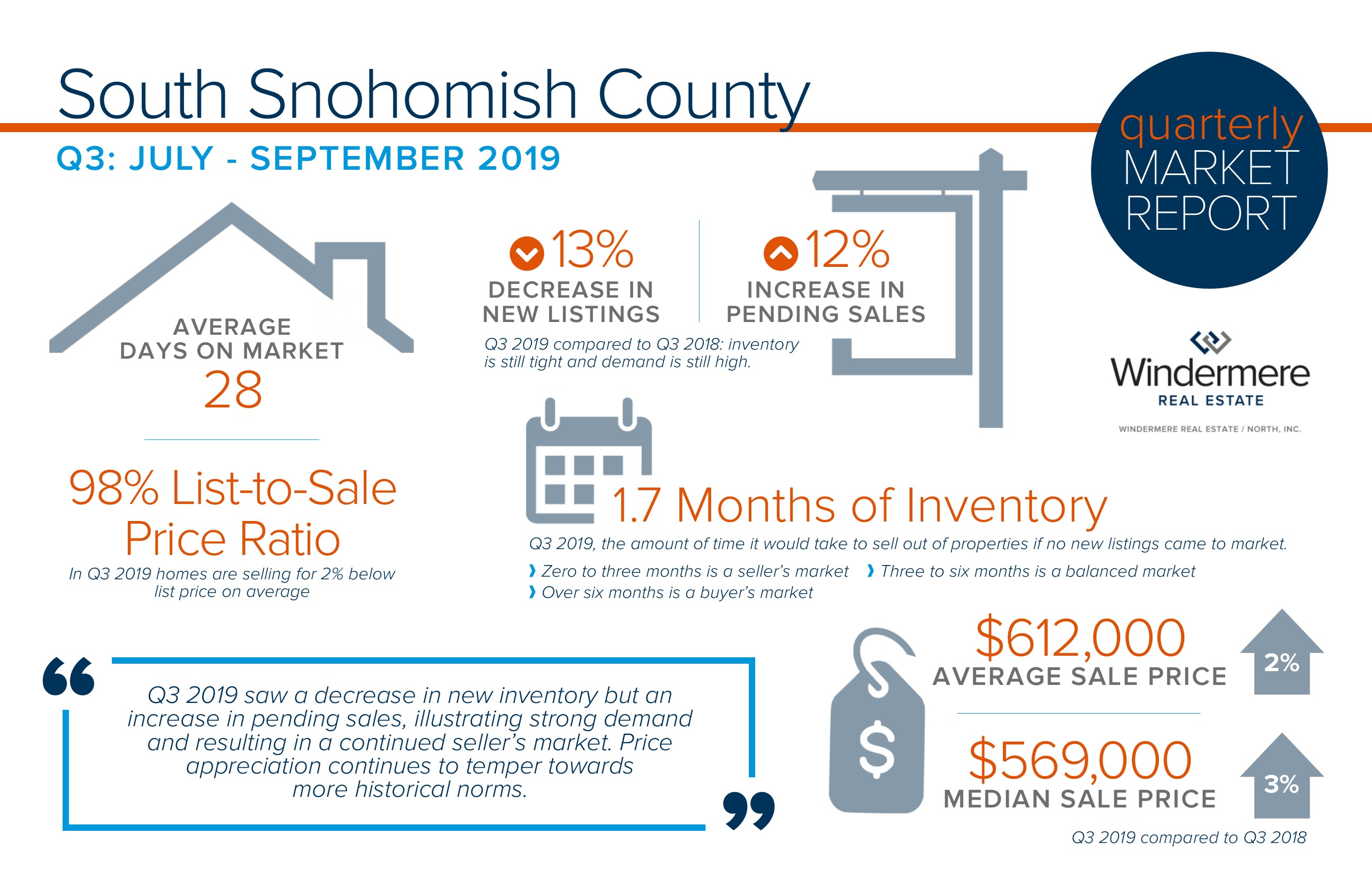

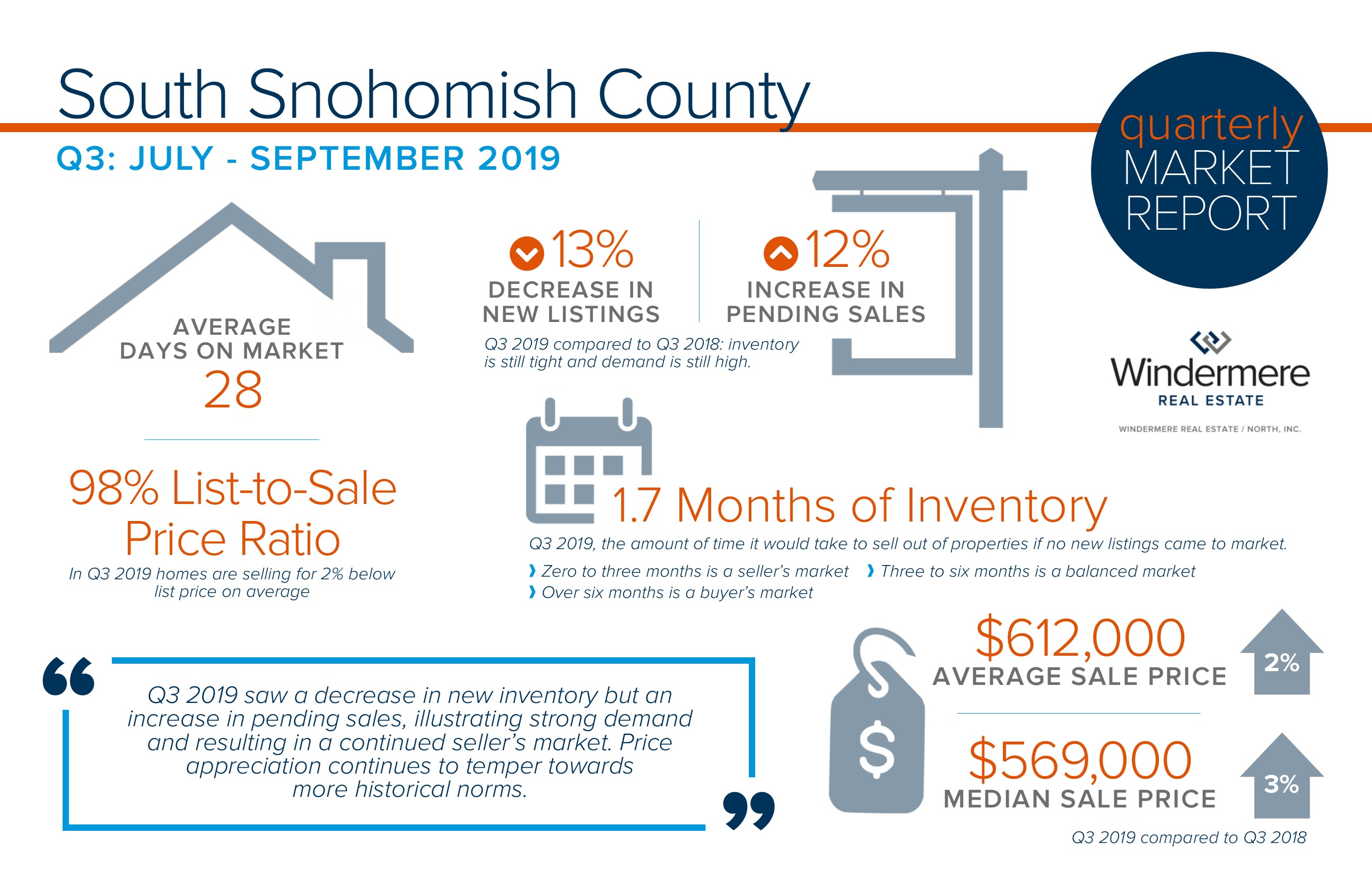

Year-over-year price growth in Western Washington continues to taper. The average home price during second quarter was $540,781, which is 2.8% higher than a year ago. When compared to first quarter of this year, prices were up 12%.

Year-over-year price growth in Western Washington continues to taper. The average home price during second quarter was $540,781, which is 2.8% higher than a year ago. When compared to first quarter of this year, prices were up 12%.

Once again, our #tacklehomelessnesscampaign is front-and-center, with the Windermere Foundation donating $100 for every Seahawks home-game defensive tackle to

Once again, our #tacklehomelessnesscampaign is front-and-center, with the Windermere Foundation donating $100 for every Seahawks home-game defensive tackle to