|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Because big parties with crowds, expensive cocktails, and massive fireworks shows aren’t the only way to ring in the new year.

The holiday season is in full swing, and the year (and the decade!) is almost over. If a big party is not your scene, you’re not alone. Some of the most fun and meaningful moments in life are a little more intimate, and shared with people we love. Below, I’ve rounded up a few ideas for ringing in the new year that are a little off the beaten path.

Staying In

Invite your favorite people to share a meal. Plan an elaborate menu, and go all-out fancy. It’s the end of a decade, after all. Not much of a cook? Plan a potluck instead. Challenge everyone to make something they wouldn’t normally cook. Or assign teams and host a cook-off competition. There are lots of possibilities, but the end result of spending the evening with those you love, reflecting on the past and planning for the future is always a win.

Gather the gang for drinks, snacks, and some good-natured smack talk. Game nights provide an easy way to laugh, play, and get out of your comfort zone, together. To avoid a game night fail, make sure you think about these three questions: 1) How many people can comfortably fit in your space 2) How many people can play the games you want to play 3) What kind of group do you want to have?

There are tons of great games you can play together, but here are some ideas, broken down by category. May the best player win!

Invite a local wine expert and a few friends to a special NYE tasting. Or, choose a type of wine and a price-point, and have everyone bring a bottle. Whether you are supplying the wine, or leaving it up to your guests, you’ll need to make sure you have enough wine glasses and a couple of good corkscrews, as well as plenty of food to soak it all up. Here are some great tips and ideas for hosting a great tasting.

If wine isn’t your thing, you could host a tasting event with beer, chocolate, or a different food item you love!

If you’d rather have a low-key, casual evening at home, throw a pajama party! Cocktails, appetizers, and jammies were definitely meant to be together! You could make it a girls night in, a sleepover, a movie marathon, a family affair… so many possibilities! To make the evening feel extra special, have a signature cocktail for the evening. Perhaps something with champagne? Plan lots of snacks, gather all the throw blankets and pillows you can find, and get cozy.

Out & About

Take a mini vacay! It could be a fun getaway for the family, a renewing solo adventure, or the ultimate date night. During the day you can do some shopping, go see a movie, take advantage of the hotel pool, or relax in the spa. Ring in the new year with a meal in the hotel restaurant, or order room service for a special treat.

Also called a Watchnight Service or Mass, the late-night New Year’s Eve religious service is a wonderful opportunity for self-reflection, renewal and preparing for the year ahead.

Spend the day volunteering your time for a worthwhile cause that is important to you. Perhaps there is a homeless shelter in your city who is looking for help serving dinner. Or a nursing home nearby, full of people who could use a friendly visitor. Make it a family day, or ask a few friends to join you. Spending time serving others can be one of the most rewarding ways to close out the year.

For a casual, fun-filled evening with friends, ring in the new year with singing, drinks, laughter, and fun. If you like the idea of karaoke, but you’re too shy to sing in front of strangers, rent a private karaoke room so only you and your closest friends can laugh at each other.

No matter how you decide to close out the year, choosing to spend your time with people you love will ensure that you have a holiday worth remembering.

Cheers!

|

|

|

|

|

|

|

|

|

|

|

|

Kick off the holiday season with a community tree lighting celebration. Thanksgiving falls late on the calendar this year, so the Christmas festivities will be right on it’s heels. Some of these celebrations start as early as the day after Thanksgiving!

The bigger celebrations feature Santa’s arrival, and most of the communities will have fun activities designed to put you and your family in the holiday spirit. live music, refreshments, crafts, and other fun activities. Santa will make an appearance at most of these as well.

Nov. 29 – Bellevue at Bellevue Place

Nov. 29 – Seattle at Westlake Center

Nov. 30 – Seattle at Pike Place Market

Nov. 30 – Tacoma at the Broadway Center

Nov. 30 – Edmonds at Centennial Plaza

Dec. 1 – Bothell on Main Street

Dec. 1 – Olympia at Sylvester Park

Dec. 6 – Mercer Island at Mercerdale Park

Dec. 6 – Mountlake Terrace at Evergreen Playfield

Dec. 6 – Renton at Coulon Park

Dec. 6 – Sammamish at City Hall

Dec. 6 – University Place (south of Tacoma)

Dec. 7 – Kenmore at City Hall

Dec. 7 – Kent at Kent Town Square Plaza

Dec 7 – Lynnwood at City Hall

Dec. 7 – Mill Creek on Main Street

Dec 7 – Mukilteo at Rosehill Community Center

Dec. 7 – West Seattle at West Seattle Junction

Dec 7 – Woodinville at DeYoung Park & Wilmot Gateway Park

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

ECONOMIC OVERVIEW

Washington State employment has softened slightly to an annual growth rate of 2%, which is still a respectable number compared to other West Coast states and the country as a whole. In all, I expect that Washington will continue to add jobs at a reasonable rate though it is clear that businesses are starting to feel the effects of the trade war with China and this is impacting hiring practices. The state unemployment rate was 4.6%, marginally higher than the 4.4% level of a year ago. My most recent economic forecast suggests that statewide job growth in 2019 will rise by 2.2%, with a total of 88,400 new jobs created.

HOME SALES

HOME PRICES

DAYS ON MARKET

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I am leaving the needle in the same position as the first and second quarters, as demand appears to still be strong.

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I am leaving the needle in the same position as the first and second quarters, as demand appears to still be strong.

The market continues to benefit from low mortgage rates. The average 30-year fixed rates is currently around 3.6% and is unlikely to rise significantly anytime soon. Even as borrowing costs remain very competitive, it’s clear buyers are not necessarily jumping at any home that comes on the market. Although it’s still a sellers’ market, buyers have become increasingly price-conscious which is reflected in slowing home price growth.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

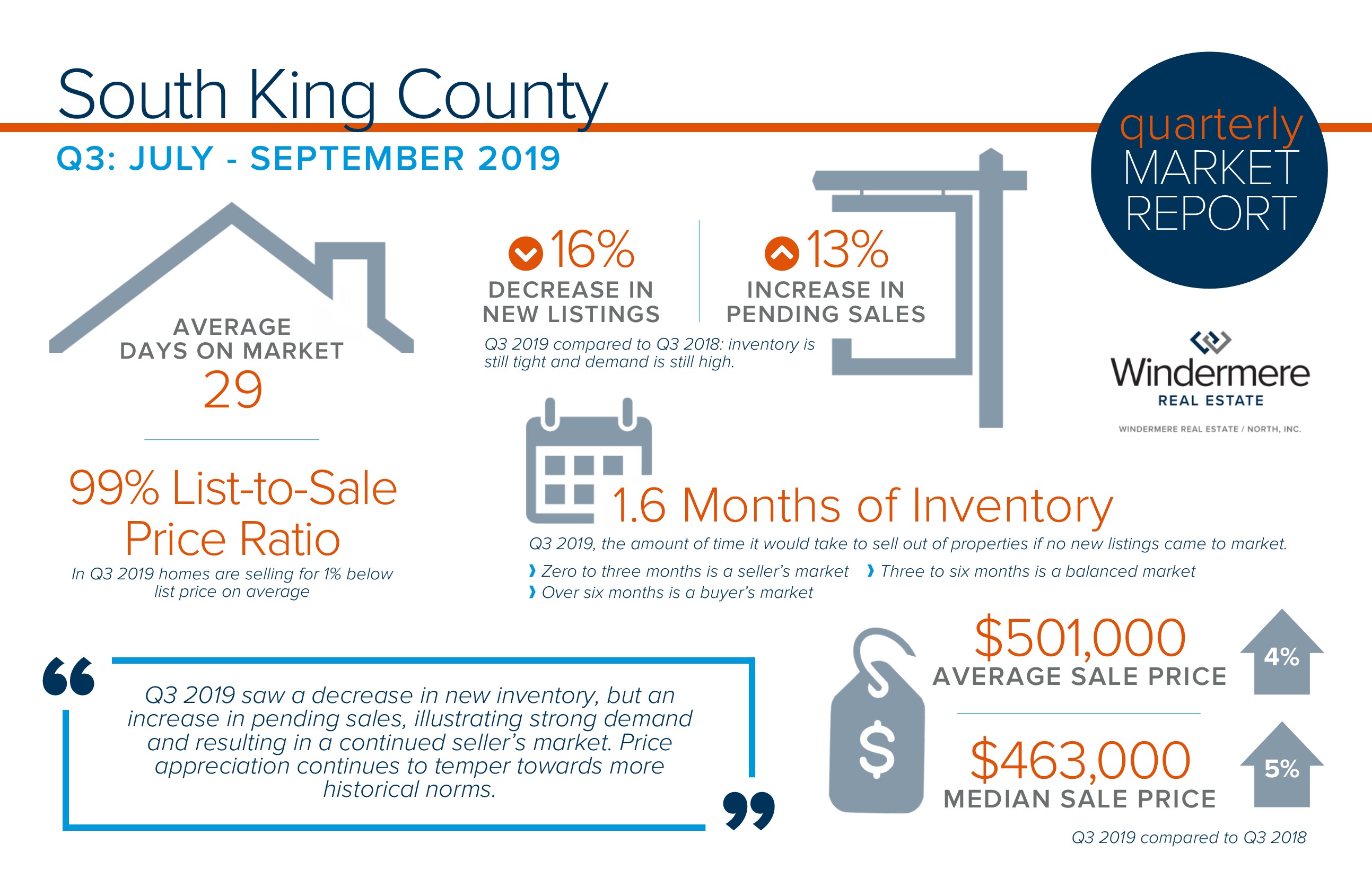

Increased pending activity is an indication of strong buyer demand which is very much being driven by historically low interest rates, a thriving job market, and an overall strong local economy. In fact, interest rates are an entire point lower than they were a year ago! This affords buyers a price point that is 10% higher over last year while maintaining the same monthly payment. A year ago, the monthly payment for a home at $500,000 is the same for a home at $550,000 today. Today’s rates coupled with tempered price appreciation provides increased affordability for buyers, which in turn is providing a healthy audience for sellers. After many years of strong price increases, many sellers are moving their equity to the next lifestyle home they desire.

This is only a snapshot of the trends in south King County; please contact me if you would like further explanation of how the latest trends relate to you.

Increased pending activity is an indication of strong buyer demand which is very much being driven by historically low interest rates, a thriving job market, and an overall strong local economy. In fact, interest rates are an entire point lower than they were a year ago! This affords buyers a price point that is 10% higher over last year while maintaining the same monthly payment. A year ago, the monthly payment for a home at $900,000 is the same for a home at $990,000 today. Today’s rates coupled with tempered price appreciation provides increased affordability for buyers, which in turn is providing a healthy audience for sellers. After many years of strong price increases, many sellers are moving their equity to the next lifestyle home they desire.

This is only a snapshot of the trends on the Eastside; please contact me if you would like further explanation of how the latest trends relate to you.

Increased pending activity is an indication of strong buyer demand which is very much being driven by historically low interest rates, a thriving job market, and an overall strong local economy. In fact, interest rates are an entire point lower than they were a year ago! This affords buyers a price point that is 10% higher over last year while maintaining the same monthly payment. A year ago, the monthly payment for a home at $750,000 is the same for a home at $825,000 today. Today’s rates coupled with tempered price appreciation provides increased affordability for buyers, which in turn is providing a healthy audience for sellers. After many years of strong price increases, many sellers are moving their equity to the next lifestyle home they desire.

This is only a snapshot of the trends in the Seattle Metro area; please contact me if you would like further explanation of how the latest trends relate to you.

Increased pending activity is an indication of strong buyer demand which is very much being driven by historically low interest rates, a thriving job market, and an overall strong local economy. In fact, interest rates are an entire point lower than they were a year ago! This affords buyers a price point that is 10% higher over last year while maintaining the same monthly payment. A year ago, the monthly payment for a home at $750,000 is the same for a home at $825,000 today. Today’s rates coupled with tempered price appreciation provides increased affordability for buyers, which in turn is providing a healthy audience for sellers. After many years of strong price increases, many sellers are moving their equity to the next lifestyle home they desire.

This is only a snapshot of the trends in north King County; please contact me if you would like further explanation of how the latest trends relate to you.