We all know that there is no magic in the first day or month of the year, and yet we are all drawn to the idea of new beginnings. A fresh start. And so with 2020 finally put to bed, many of us are setting goals for this fresh, new year.

The topic of new year’s resolutions or goals can be a polarizing one. The fact that most people give up on or forget about their resolutions within a month or two is a widely known fact. So is it better to avoid setting goals entirely? Should we make broad, unrealistic resolutions knowing they won’t last, just to feel like we’re doing something?

If we set goals simply because we feel like we should, or because we are wishing for change in our lives, there is little chance they will be accomplished. There must be a deep-rooted reason for setting a goal so that there is lasting motivation to achieve it. They must be attainable. And we must have grace for ourselves for when we inevitably fall off the wagon.

I have put together a few thoughts to consider during this first month of 2021:

Give Yourself Grace

Arguably the most important aspect of goal setting, and for many, the most difficult. We are all going to mess up at some point. Forget to do the thing we decided to do. Skip a day. Sleep in.

The big question is – do we let our guilt paralyze us from getting back on track? Do we slip into self-pity and frustration, losing sight of our desired outcome? Enter grace. Self-compassion.

There are three important aspects to self-compassion:

- Be mindful (instead of identifying with the problem). For example, be mindful of the fact that you are struggling with exercising regularly, instead of seeing yourself as a failure at exercise.

- Connect with other people (instead of isolating yourself). For example, realize that you are probably not the only one who struggles with exercise. Talk about your struggle with people who love and support you.

- Be kind to yourself (instead of being judgmental). For example, try saying to yourself “I forgive myself for my shortcomings, and I will try again.”

Self-compassion means applying the same understanding and kindness we have for other people to ourselves. Because everyone is worthy of compassion.

Goals > Resolutions

Words matter. A resolution is a firm decision to do or not do something. A goal is the object of a person’s effort.

Setting a goal provide us with a direction to follow. Goals require intention, planning and action, but they are less rigid than all-or-nothing resolutions. Often when we are shooting for a goal, even if we do not achieve exactly what we aimed for, we will still end up closer to it than when we started. Progress in the right direction is every bit as important as hitting that goal.

Is it Necessary?

When everyone around us is making changes and launching new things, it is easy to get swept up in the feeling of needing to do something. Before making any decisions or setting goals, ask yourself if it really needs to change. Or do you just want to feel like you’re doing something?

Often, change is needed. Other times, we would be better off sticking to what we are already doing. Part of the goal-setting process should always include serious thought and research on the things in your life or business that genuinely require change or movement.

Consider the Impact

Once we have decided that something does, indeed need to change, it is important to spend some time thinking about the impact that this change will have. How will it make you feel? What will it bring to your life?

This gives us something to hold on to when we are wavering down the road. Hold tight to the feeling or the outcome this change will make in your life and keep coming back to that when things are hard.

Break it Down

Everyone’s heard this advice before, but it’s incredibly important to break our goals down into manageable bite-size pieces. Setting broad goals will inspire frustration and discouragement when they aren’t achieved. Small, specific goals are more doable, keeps us from getting overwhelmed, and each little “win” provides motivation to keep going.

If you’ve already set your 2021 goals, I invite you to reflect on what you have set, why you have set them, and how you can show self-compassion in 2021. Remember that it isn’t about changing things to fit the perfect “mold”, but figuring out what it is we really want to do. Let’s make changes in a sustainable way that allows us space to be kind to ourselves along the way.

A new year is a great opportunity to set goals and work towards change. But really, any day is an opportunity. What are you working towards today?

s in 2020.

s in 2020. Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link

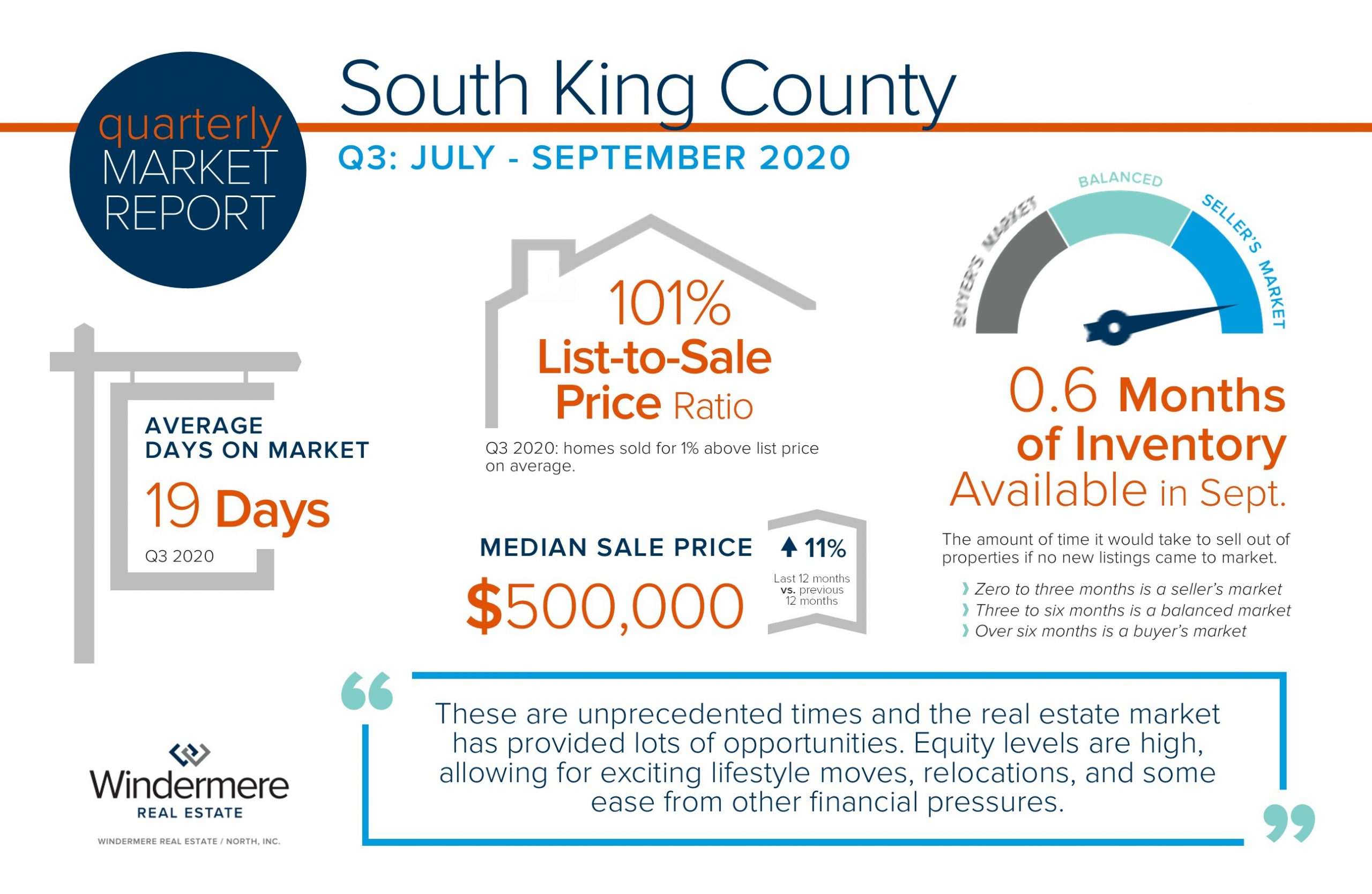

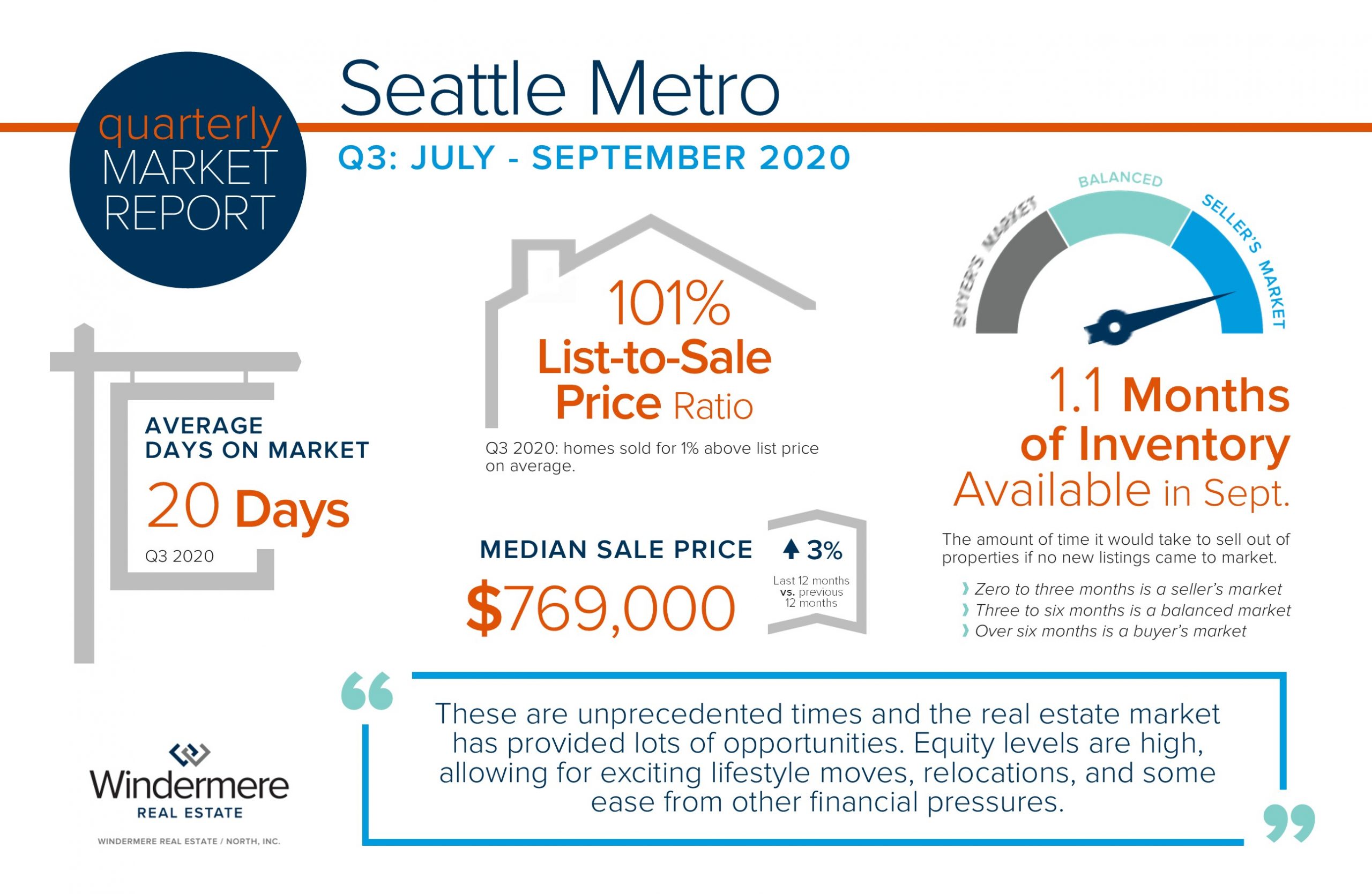

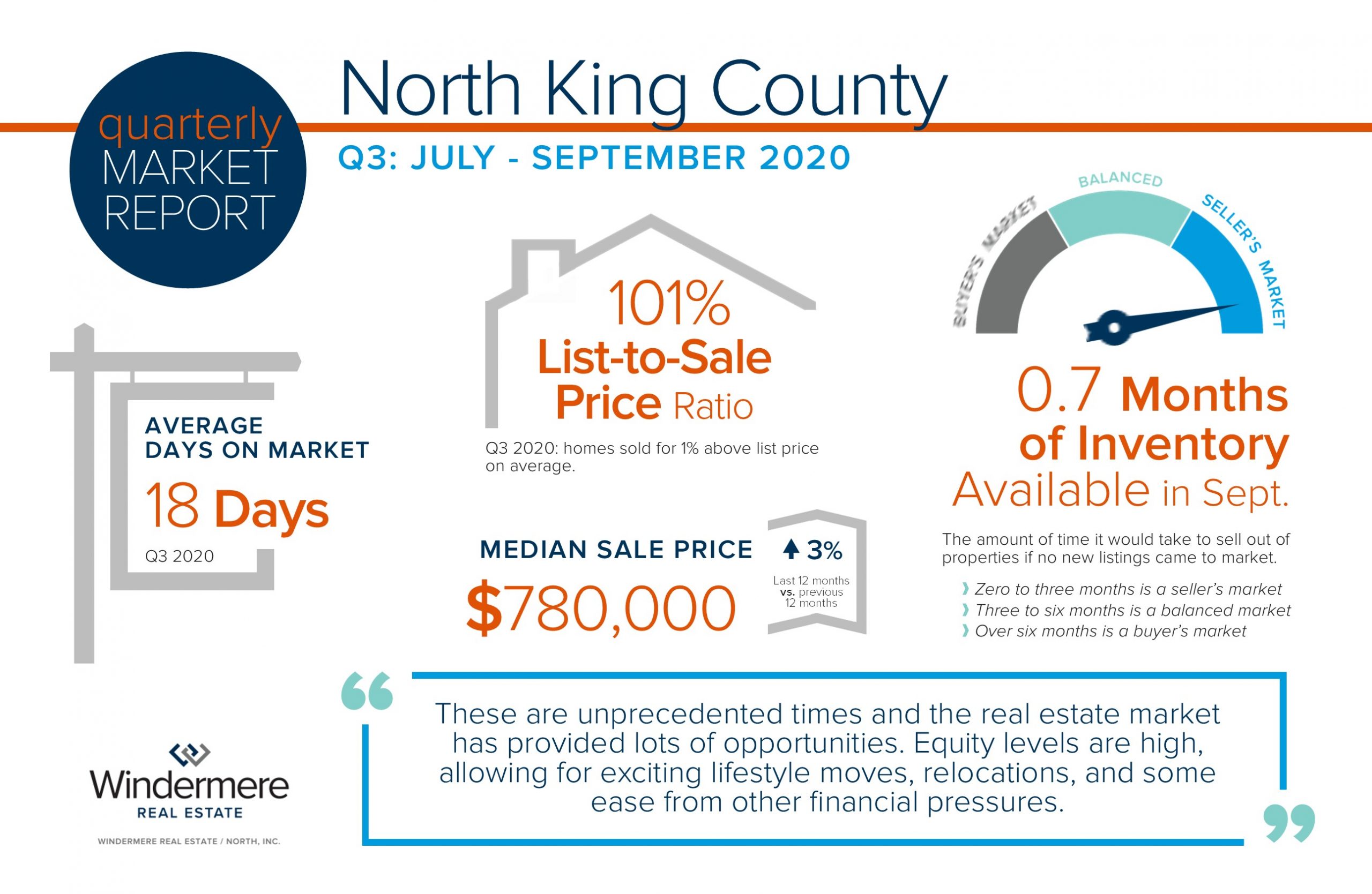

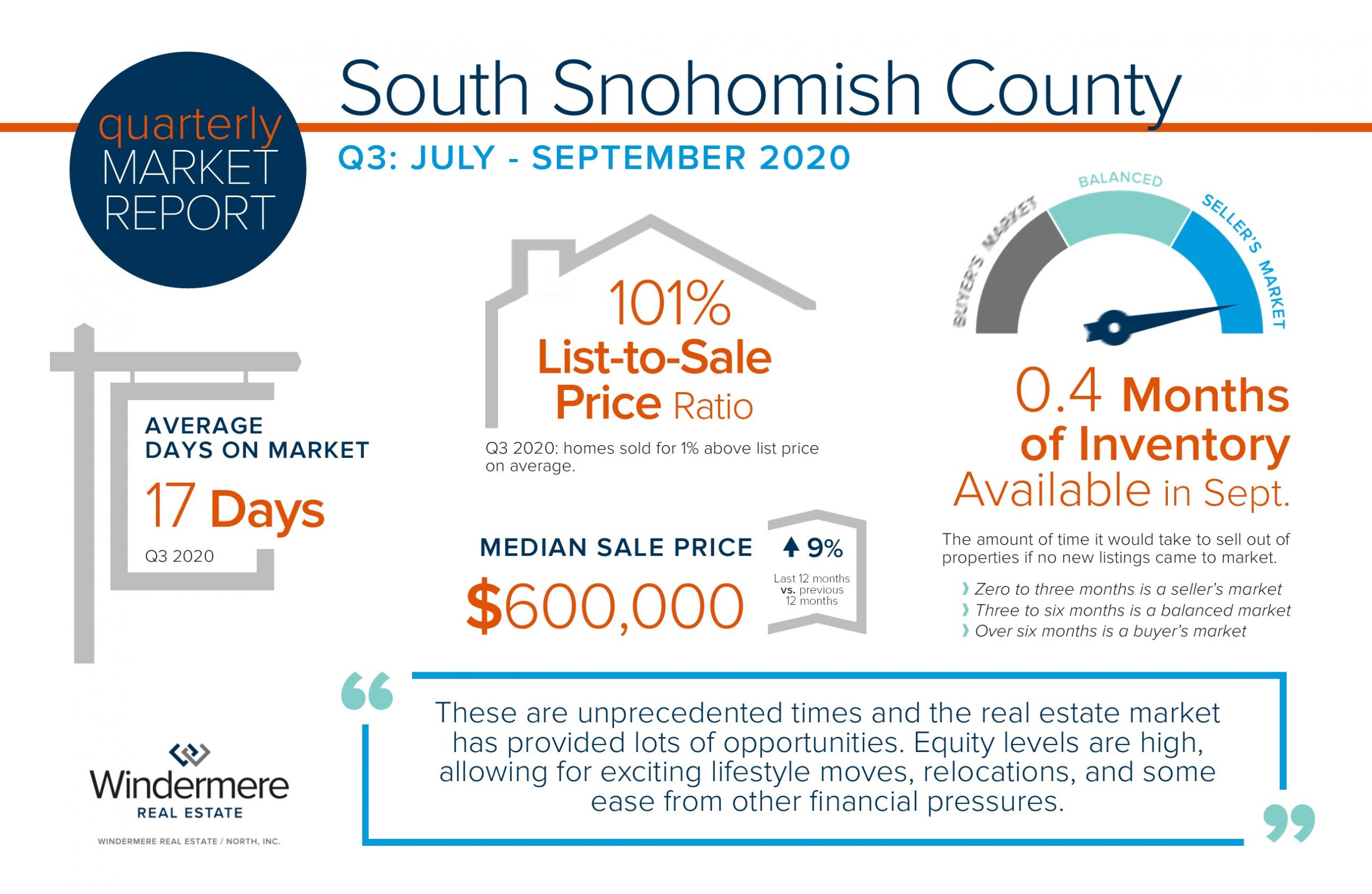

Equity levels across our nation are formidable. 42% of homeowners own their home free-and-clear and 58% of homeowners have 60% equity or more! Unlike the Great Recession of 2008 that was centered on housing, we are experiencing quite the opposite. With unemployment still an important issue, some homeowners will utilize their positive equity position to help relieve financial pressure as they pivot to an alternative career path and/or geographic location. Housing will be a tool for some to navigate the economic uncertainty the pandemic has caused.

Equity levels across our nation are formidable. 42% of homeowners own their home free-and-clear and 58% of homeowners have 60% equity or more! Unlike the Great Recession of 2008 that was centered on housing, we are experiencing quite the opposite. With unemployment still an important issue, some homeowners will utilize their positive equity position to help relieve financial pressure as they pivot to an alternative career path and/or geographic location. Housing will be a tool for some to navigate the economic uncertainty the pandemic has caused.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.