|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The pressure to come up with resolutions and improvements always mounts near the end of the year, but everyone knows that statistically speaking, most of us won’t stick to our New Year’s resolutions much past February. So rather than give in to societal pressure, guilt, and feelings of hopelessness, I propose a shift in perspective this year.

Rather than viewing the New Year as catalyst for sweeping lifestyle and character changes, let’s instead take this opportunity to renew our sense of purpose and determination. Here are five ideas to make some positive changes in a different way this year.

“Gratitude can transform common days into thanksgivings, turn routine jobs into joy, and change ordinary opportunities into blessings.” -William Arthur Ward. You will be amazed at the ways your life will begin to change simply by expressing gratitude regularly. It will help you maintain a fresh perspective day in and day out, and will help to keep stress at bay. Make a list of all the things you are thankful for in your life, big and small. Take some time to really lean in to this list and reflect on each one. Especially focus on why you are thankful for each of those things.

This goes hand-in-hand with gratitude. What are you looking forward to this year? A vacation, a family member getting married, a new restaurant opening, a new novel or a new season of your favorite show. By focusing on the good things coming your way, it will be easier to keep a positive and hope-filled attitude.

Before the year starts, take some time to look at the big picture of the coming year. Find the theme of what you would like to accomplish or focus on, and chose a theme word to guide you. This will give you clarity and focus. Maybe your word for the year is Intentional. Simplify. Peace. Discipline. Fun. When you have your theme word for the year, share it on oneword365.com

Life happens, and trying to balance work, family, social life, friends, and other commitments often results in very little time for you. Take some time before the new year starts and schedule yourself a quarterly one-day (or weekend!) retreat to focus on YOU. Remember, if you don’t take care of yourself, you won’t be able to take care of anyone else.

A 30-day challenge consists of setting a small goal that can be achieved in 30 days, as well as a small, specific action that you will take each day to achieve that goal. For example:

Declutter: every day for 30 days, choose 3 items to donate, sell, give away or throw away.

Random acts of kindness: every day for 30 days, perform a random act of kindness such as: leaving change in a vending machine; buying the coffee of the person behind you at Starbucks; send a thank you email to a coworker who deserves more recognition. Spreading kindness will always come back to you.

Happy New Year!

New Year’s Eve 2018 is almost upon us, and if you are still looking for something to do, read on! There are lots of options in the greater Seattle area, whether you are looking for the biggest blow-out bash or an earlier, family-friendly event.

There are actually two parties that will converge at midnight for the iconic Seattle fireworks show.

The Armory Stage will host rock band SWAY from 8pm until midnight. And at the International Fountain, you can dance the night away with live electronic music and video projection show (starts at 10pm). Tickets are required for both parties, however the big fireworks show is free to enjoy.

The Pacific Science Center transforms on NYE with fire sculptures, drinks and live music. There will be special entertainment throughout the night, as well as the standard Science Center exhibits. At midnight, head outside for the Space Needle fireworks. Purchase tickets in advance.

Watch the Seattle Center fireworks from under the glass of Chihuly Gardens. The evening includes appetizers, desserts, live music and a midnight toast. Purchase tickets in advance.

Another Seattle Center option, the Museum of Popular Culture offers four 21+ parties in one. With live music on three performance stages, comedians, party favors, special VIP areas, more than 20 bars, and a special singles-only cocktail hour, this is one of the largest parties of the year. Museum access is included in the price of the party, purchase tickets in advance.

First Night is an all-ages, family-friendly celebration in Downtown Tacoma’s Theater District. The affordable admission price includes museums, music, art, drama, dance, and a whole day and night of activities. The cost of entry increases as the festival gets closer, so buy early to save!

The perfect NYE celebration if you have older kids, this pajama party features comedians, balloon makers, pizza, snacks, and educational, hands-on activities throughout the night. The fun culminates at 9pm with a ball drop.

Ivar’s on Northlake will host live music, tasty food and view of the fireworks without the crowds. Advanced reservations are required, and will range in price depending on your selections.

Ring in the new year with the latest in R&B, Old School, Jazz and Hip Hop music. This is a 21+, semi-formal event, and hotel packages are available with your ticket purchase.

A Seattle tradition for almost a decade, this 18+ party always brings a mixed crowd together for a night of dancing. This is one of the biggest EDM parties of the year.

Celebrate the coming new year all day at KidsQuest! There are activities every hour from 10am to 4pm, including Bubble Wrap Stomp, New Year’s Hats, Storytime, glittery tattoos, and more. Admission is free with membership or museum admission.

è King County:

♦ Buttonwood Farm

14500 NE 116th St, Redmond

100% organic you-cut or white-glove delivery service, saws provided, hot chocolate and cookies

♦ Carnation Tree Farm

31523 NE 40th St, Carnation

You-cut trees, pre-cut trees, wreaths, garlands, mistletoe, Santa visits, Christmas decorations, trees baled, saws provided, hay rides

♦ Cedar Falls Tree Farm

15200 Cedar Falls Rd SE, North Bend

You-cut trees, wreaths, trees bagged & tied, saws provided, free hot cider, picnic area, porta-potties

♦ Christmas Creek Tree Farm

15515 468th Ave SE, North Bend

You-cut trees, pre-cut trees, trees baled, refreshments, hay rides, Santa on weekends, picnic areas

♦ Coates Christmas Trees

17225 SE Green Valley Road, Auburn

You-cut trees, pre-cut trees, wreaths, boughs, garlands, mistleto, Santa, trees bagged and tied

♦ Country Tree Farm

18225 116th Ave SE, Renton

You-cut trees, wreaths, holly, refreshments, Santa

♦ Crown Tree Farm

13005 424th Ave SE, North Bend

You-cut trees, pre-cut trees, wreaths and boughs, decorations, saws provided, trees bagged, free tree trimmings

♦ Crystal Creek Tree Farm

23604 SE 192nd St, Maple Valley

You-cut trees, saws provided, trees baled, cider, porta-potties

♦ Enchanted Winds Tree Farm

8021 Issaquah-Hobart Rd, Issaquah

You-cut trees, wreaths, swags, boughs, holly, gifts, decorations, crafts, trees baled, tree stands, hay wagon, trailer rides, fire pit, hot beverages

♦ Hunter Farms Fresh Cut Trees

7744 35th Ave NE, Seattle

Precut trees, mistletoe, holly, wreaths, flocking, restrooms, trees baled, fire retarding

♦ Keith and Scott Tree Farm

42999 SE 120th St, North Bend

You-cut trees, pre-cut trees, wreaths, boughs, trees tied, baled and trimmed, saws provided, bonfires, refreshments, restrooms

♦ McMurtrey’s Red-wood Christmas Tree Farm

13925 Redmond-Woodinville Rd, Redmond

You-cut trees, pre-cut trees, saws provided, wreaths, beverages, restrooms, wagon rides, tree stands

♦ Serres Farm

20306 NE 50th St, Redmond

You-cut trees, pre-cut trees, saws provided, wreaths, free hot chocolate, restrooms

♦ Snow Valley Christmas Tree Farm

17651 W Snoqualmie River Rd NE, Duvall

You-cut trees, pre-cut trees, wreaths, Santa appearances, decorations, free hot beverages, gift shop, porta-potties

è Snohomish County:

♦ Bowen Tree Farm

19301 95th Ave NE, Arlington

You-cut trees, wreaths, decorations, free hot cider, gift shop, porta-potties

♦ Farmer Brown’s Tree Farm

12017 109th Ave NE, Arlington

You-cut trees, saws provided, hot beverages, flocking, gift shop, restrooms

♦ Hemstrom Valley Tree Farm

4329 Robe Menzel Road, Granite Falls

You-cut trees, saws provided, winter events, refreshments

♦ Holiday Forest

3125 280th St NW, Stanwood

You-cut trees, wreaths, boughs, saws provided, winter wagon rides, snacks and refreshment stand

♦ Lochsloy Acres

5511 State Route 92, Lake Stevens

You-cut trees, wreaths, boughs, saws provided, free coffee, cider & hot chocolate

♦ Paterson’s Lazy Acres Tree Farm

1315 188th St NE, Arlington

You-cut trees, saws provided, trees baled, wreaths, decorations, refreshments

♦ Pilchuck Secret Valley Christmas Trees

9533 Mose Rd, Arlington

You-cut trees, wreaths, swags, boughs, holly, picnic area, fire pit, hot beverages, restrooms

♦ Stocker Farms

8705 Marsh Rd, Snohomish

You-cut trees, saws provided, warming fire

♦ Wintergreen Tree Farm

13606 S Machias Rd, Snohomish

Precut trees, you choose and you cut trees, wreaths, boughs, garlands, decorations, Christmas festival, bonfires, free hot cider, gift shop, restrooms

Remember to always call the farm before you go to confirm their supply, hours, if they are allowing choose-and-cut or just pre-cut trees, and which attractions or winter activities are available. All of these things can change quickly during the short Christmas season due to weather, demand, and the farmers business conditions!

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ECONOMIC OVERVIEW

Washington State continues to be one of the fastest growing states in the nation and there is little to suggest that there will be any marked slowdown in the foreseeable future. Over the past year, the state has added 105,900 new jobs, representing an annual growth rate of 3.2%. This remains well above the national rate of 1.65%. Private sector employment gains continue to be robust, increasing at an annual rate of 3.7%. The strongest growth sectors were Construction (+7.4%), Information (+6.2%), and Professional & Business Services (+6.1%). The state’s unemployment rate was 4.5%, down from 4.8% a year ago.

All year I’ve been predicting that Washington State’s annual job growth would outperform the nation as a whole, and we now know with certainty that this is going to be the case. Furthermore, I am now able to predict that statewide job growth in 2019 will be equally strong, with an expected increase of 2.6%.

HOME SALES ACTIVITY

HOME PRICES

DAYS ON MARKET

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors. I started to move the needle toward buyers last quarter and have moved it even further this quarter. Price growth continues to slow, but more significant is the rise in listings, which I expect to continue as we move toward the quieter winter period.

I believe that psychology will start to play a part in the housing market going forward. It has been more than 15 years since we’ve experienced a “balanced” market, so many home buyers and sellers have a hard time remembering what one looks like. Concerns over price drops are overrated and the length of time it’s taking to sell a home is simply trending back to where it used to be in the early 2000s.

Mr. Gardner is the Chief Economist for Windermere Real Estate, specializing in residential market analysis, commercial/industrial market analysis, financial analysis, and land use and regional economics. He is the former Principal of Gardner Economics and has more than 30 years of professional experience both in the U.S. and U.K.

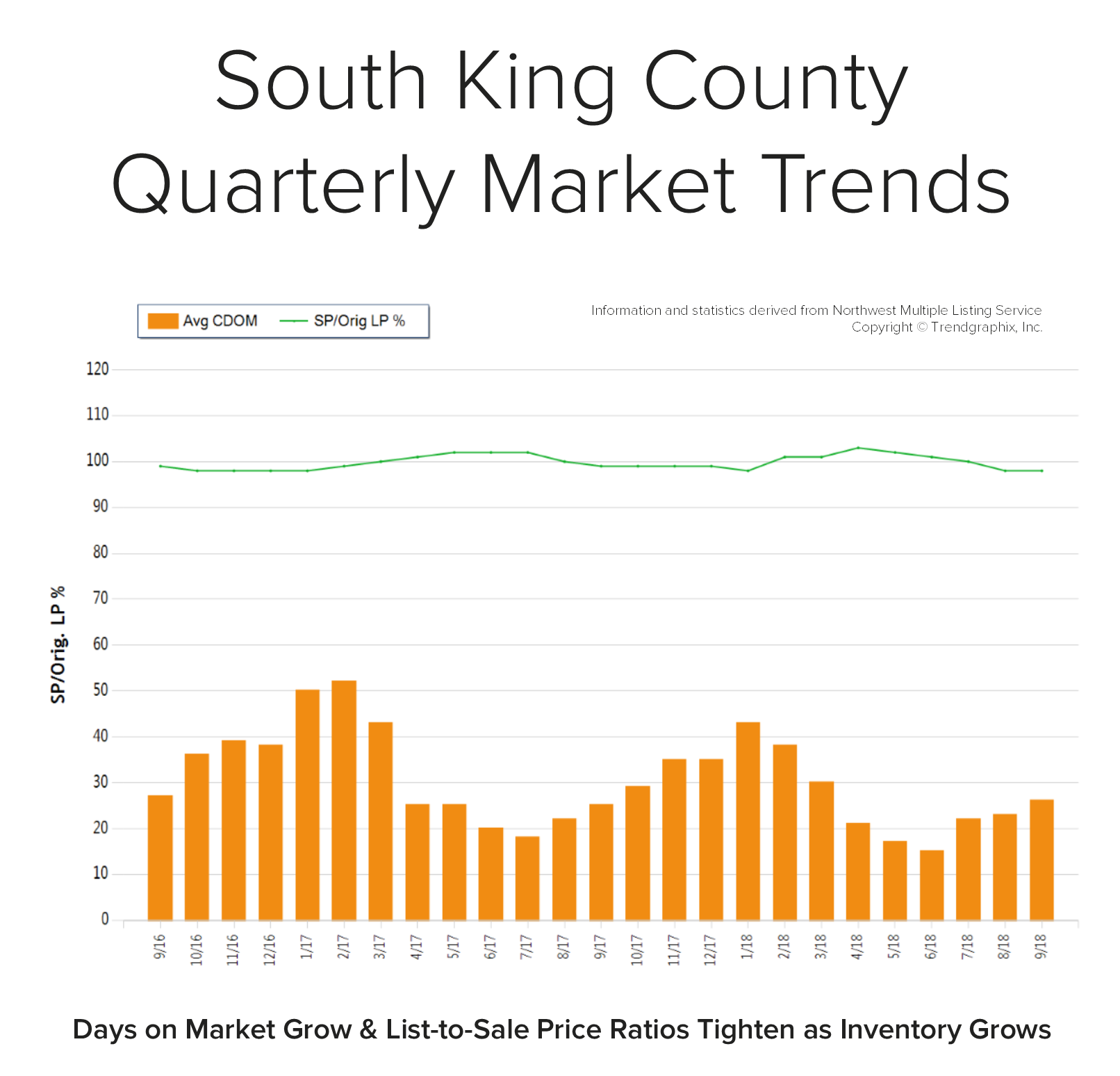

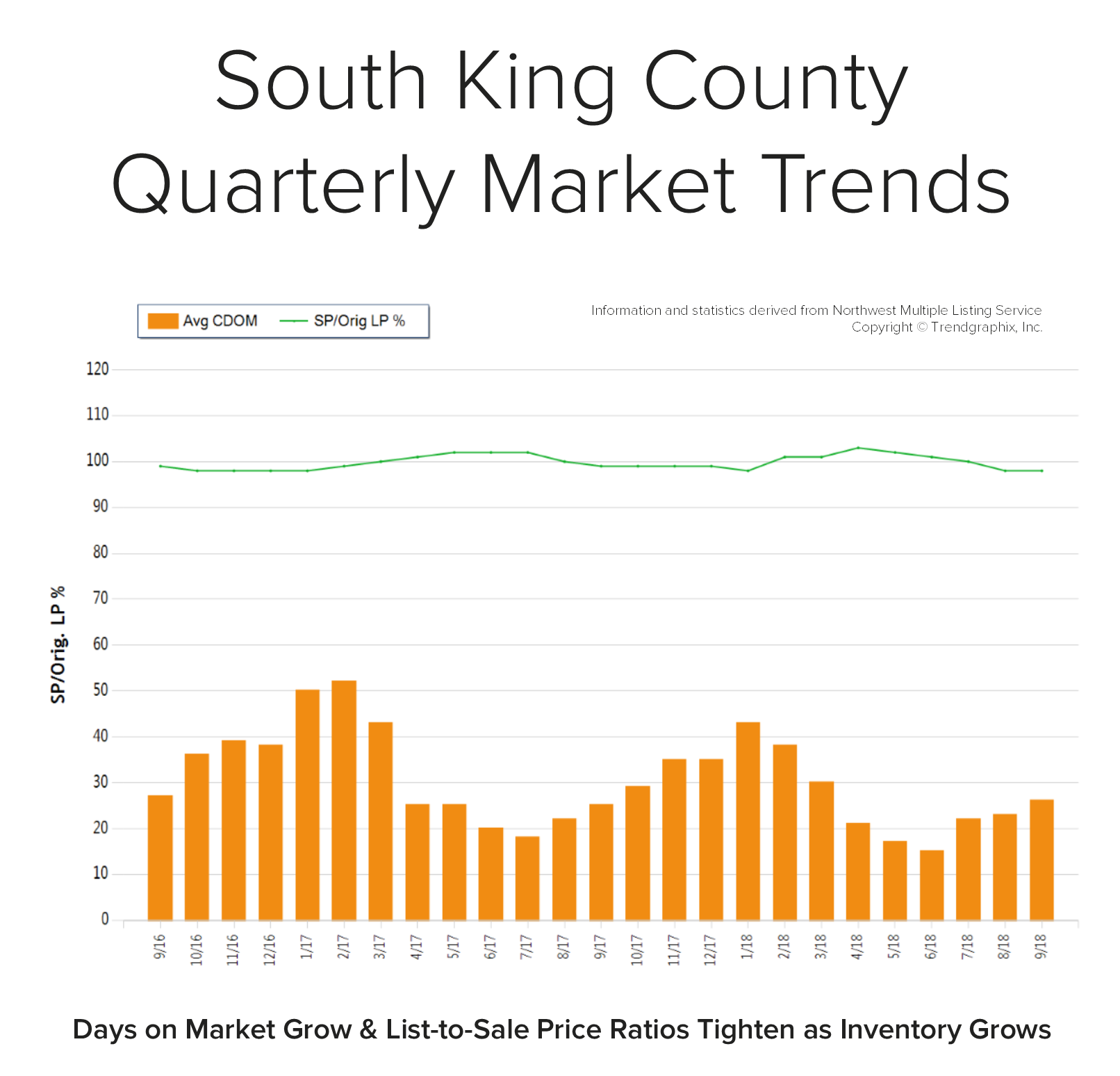

In September, the average days on market landed at 26 days and the original list-to-sale price ratio 98%. Since May, inventory growth has been noticeable, and has given buyers more options. This has led to more negotiations and fewer bidding wars, which is tempering month-over-month price growth to a more sustainable level. Back in April, the average days on market was 21 days and the original list-to-sale price ratio 103%; but months of inventory based on pending sales was 0.9 months, compared to 2.6 months currently. Year-over-year, prices are up 10%, still well above the historical norm of 3%-5% year-over-year gains—but note that the majority of this growth happened during the spring, due to constricted inventory levels.

Supply has increased, creating more options for buyers and helping to buffer affordability  issues. Many sellers are deciding to make moves and cash in on the equity gained over the last six years. An average original list-to-sale price ratio of 98% is a positive return, yet illustrates a softening in the market after some very extreme times. With 10% price growth over the last 12-months in a seller’s favor, the increase in selection has led to more nimble moves from one house to another. Where sellers need to be careful is anticipating the month-over-month price growth we saw prior to the shift in inventory. Prospective buyers would be smart to take advantage of today’s historically low interest rates and the added inventory selection.

issues. Many sellers are deciding to make moves and cash in on the equity gained over the last six years. An average original list-to-sale price ratio of 98% is a positive return, yet illustrates a softening in the market after some very extreme times. With 10% price growth over the last 12-months in a seller’s favor, the increase in selection has led to more nimble moves from one house to another. Where sellers need to be careful is anticipating the month-over-month price growth we saw prior to the shift in inventory. Prospective buyers would be smart to take advantage of today’s historically low interest rates and the added inventory selection.

This is only a snapshot of the trends in south King County; please contact me if you would like further explanation of how the latest trends relate to you.

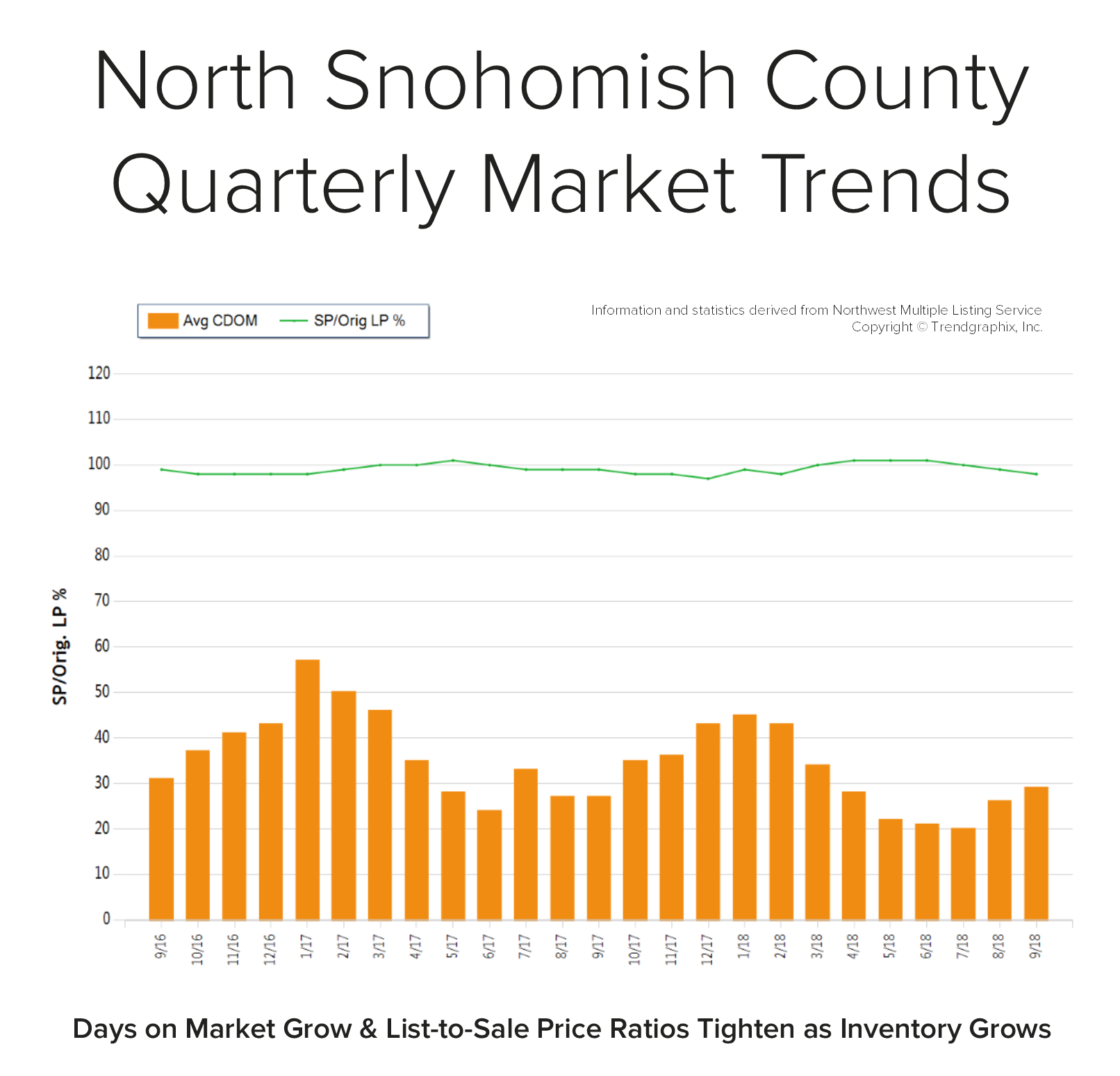

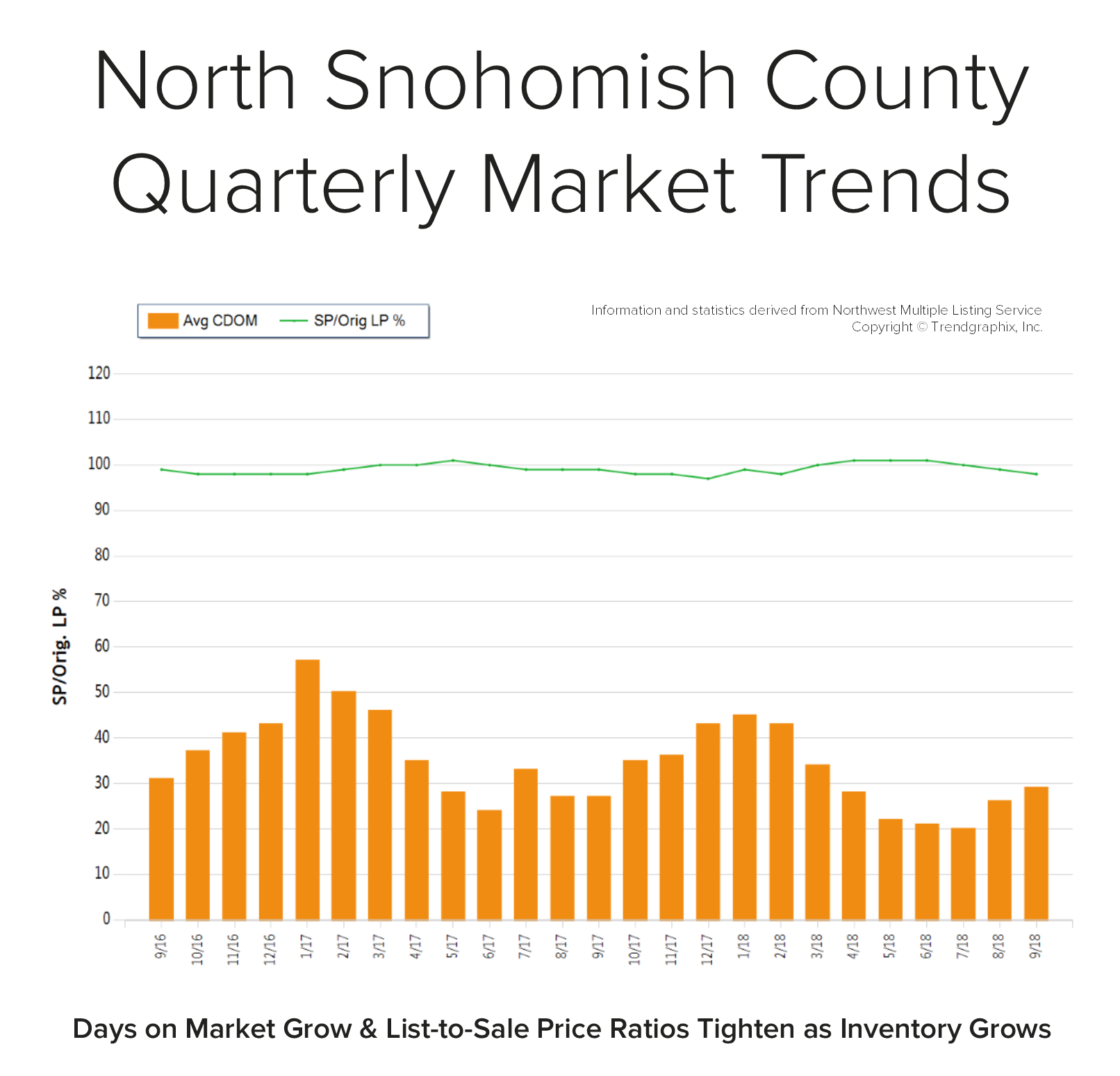

In September, the average days on market landed at 29 days and the original list-to-sale price ratio at 98%. Since May, inventory growth has been noticeable, and has given buyers more options. This has led to more negotiations and fewer bidding wars, which is tempering month-over-month price growth to a more sustainable level. Back in May, the average days on market was 22 days and the original list-to-sale price ratio 101%; but months of inventory based on pending sales was 1 month compared to 2.3 months currently. Year-over-year, prices are up 11%, still well above the historical norm of 3%-5% year-over-year gains—but note that the majority of this growth happened during the spring, due to constricted inventory levels.

Supply has increased, creating more options for buyers and helping to buffer affordabili ty issues. Many sellers are deciding to make moves and cash in on the equity gained over the last six years. An average original list-to-sale price ratio of 98% is a positive return, yet illustrates a softening in the market after some very extreme times. With 11% price growth over the last 12-months in a seller’s favor, the increase in selection has led to more nimble moves from one house to another. Where sellers need to be careful is anticipating the month-over-month price growth we saw prior to the shift in inventory. Prospective buyers would be smart to take advantage of today’s historically low interest rates and the added inventory selection.

ty issues. Many sellers are deciding to make moves and cash in on the equity gained over the last six years. An average original list-to-sale price ratio of 98% is a positive return, yet illustrates a softening in the market after some very extreme times. With 11% price growth over the last 12-months in a seller’s favor, the increase in selection has led to more nimble moves from one house to another. Where sellers need to be careful is anticipating the month-over-month price growth we saw prior to the shift in inventory. Prospective buyers would be smart to take advantage of today’s historically low interest rates and the added inventory selection.

This is only a snapshot of the trends in north Snohomish County; please contact me if you would like further explanation of how the latest trends relate to you.

In September, the average days on market landed at 23 days and the original list-to-sale price ratio 98%. Since May, inventory growth has been noticeable, and has given buyers more options. This has led to more negotiations and fewer bidding wars, which is tempering month-over-month price growth to a more sustainable level. Back in April, the average days on market was 11 days and the original list-to-sale price ratio 105%; but months of inventory based on pending sales was 0.8 months, compared to 2.4 months currently. Year-over-year, prices are up 11%, still well above the historical norm of 3%-5% year-over-year gains—but note that the majority of this growth happened during the spring, due to constr icted inventory levels.

icted inventory levels.

Supply has increased, creating more options for buyers and helping to buffer affordability issues. Many sellers are deciding to make moves and cash in on the equity gained over the last six years. An average original list-to-sale price ratio of 98% is a positive return, yet illustrates a softening in the market after some very extreme times. With 10% price growth over the last 12-months in a seller’s favor, the increase in selection has led to more nimble moves from one house to another. Where sellers need to be careful is anticipating the month-over-month price growth we saw prior to the shift in inventory. Prospective buyers would be smart to take advantage of today’s historically low interest rates and the added inventory selection.

This is only a snapshot of the trends in the Seattle Metro area; please contact me if you would like further explanation of how the latest trends relate to you.