|

|

|

|

|

|

|

|

|

|

|

|

The following analysis of select counties of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere Real Estate agent.

Regional Economic Overview

Although the job market in Western Washington continues to grow, the pace has started to slow. The region added over 91,000 new jobs during the past year, but the 12-month growth rate is now below 100,000, a level we have not seen since the start of the post-COVID job recovery. That said, all but three counties have recovered completely from their pandemic job losses and total regional employment is up more than 52,000 jobs. The regional unemployment rate in November was 3.8%, which was marginally above the 3.7% level of a year ago. Many business owners across the country are pondering whether we are likely to enter a recession this year. As a result, it’s very possible that they will start to slow their expansion in anticipation of an economic contraction.

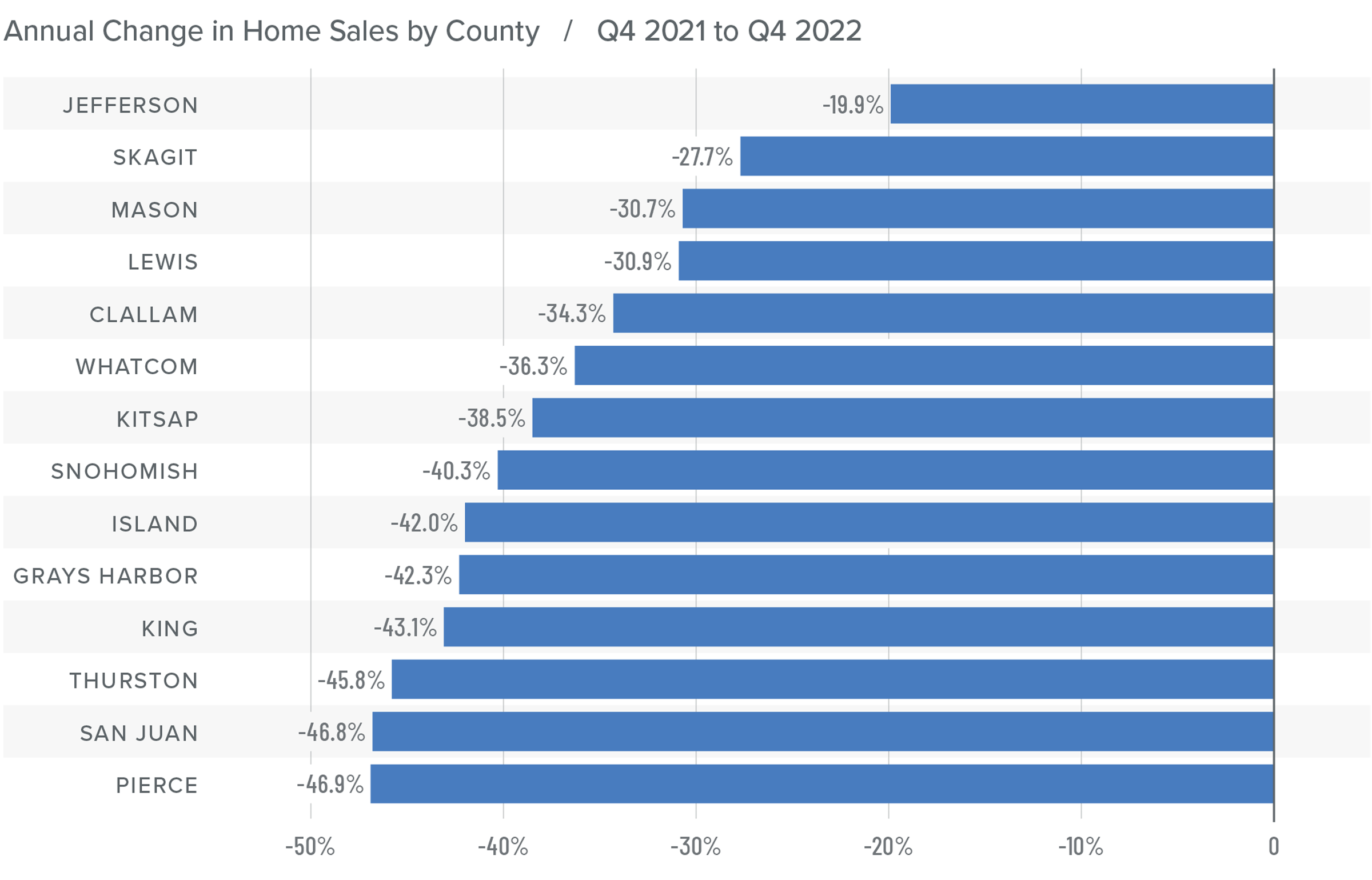

❱ In the final quarter of 2022, 12,711 homes sold, representing a drop of 42% from the same period in 2021. Sales were 34.7% lower than in the third quarter of 2022.

❱ Listing activity rose in every market year over year but fell more than 26% compared to the third quarter, which is expected given the time of year.

❱ Home sales fell across the board relative to the fourth quarter of 2021 and the third quarter of 2022.

❱ Pending sales (demand) outpaced listings (supply) by a factor of 1:2. This was down from 1:6 in the third quarter. That ratio has been trending lower for the past year, which suggests that buyers are being more cautious and may be waiting for mortgage rates to drop.

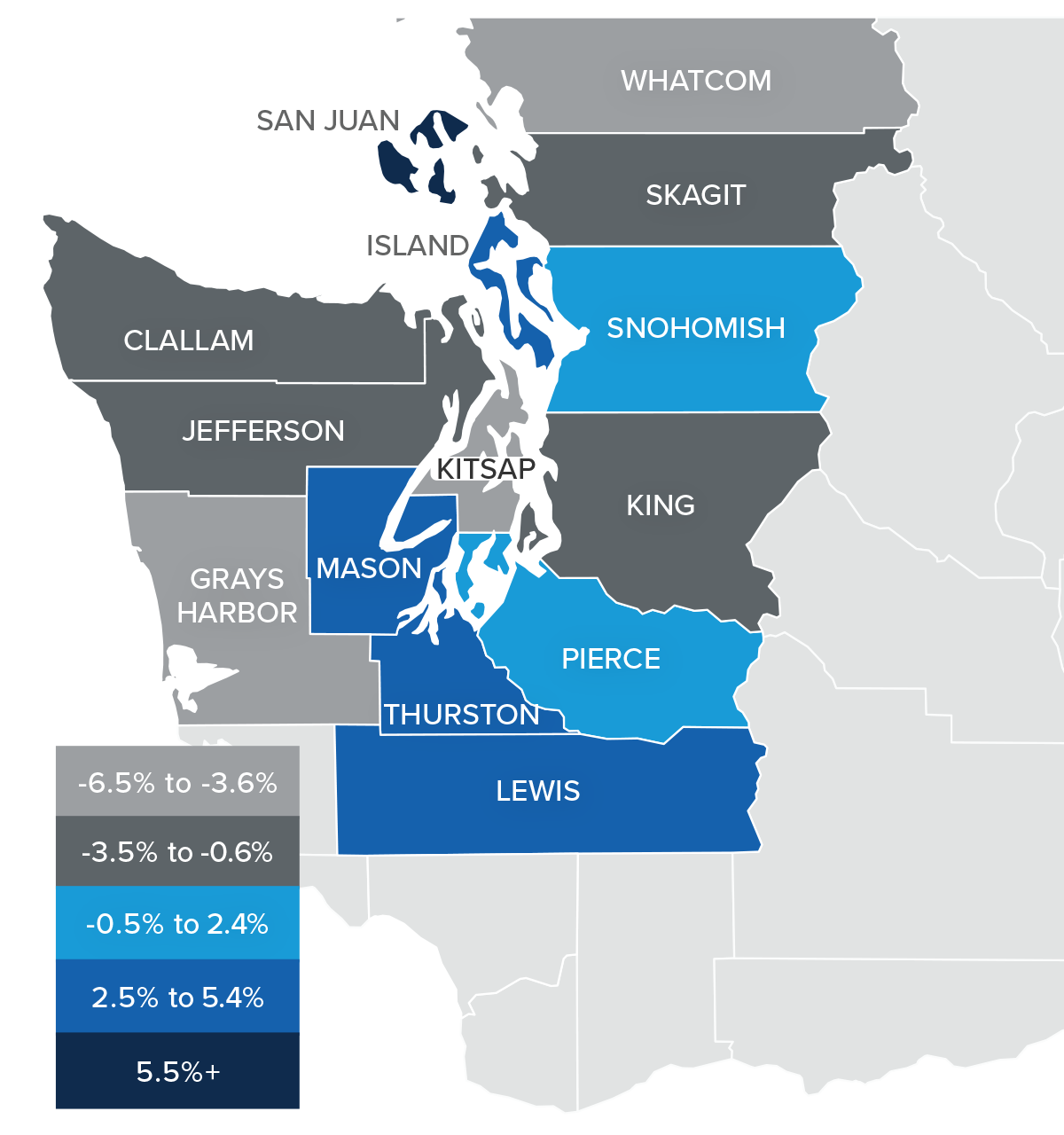

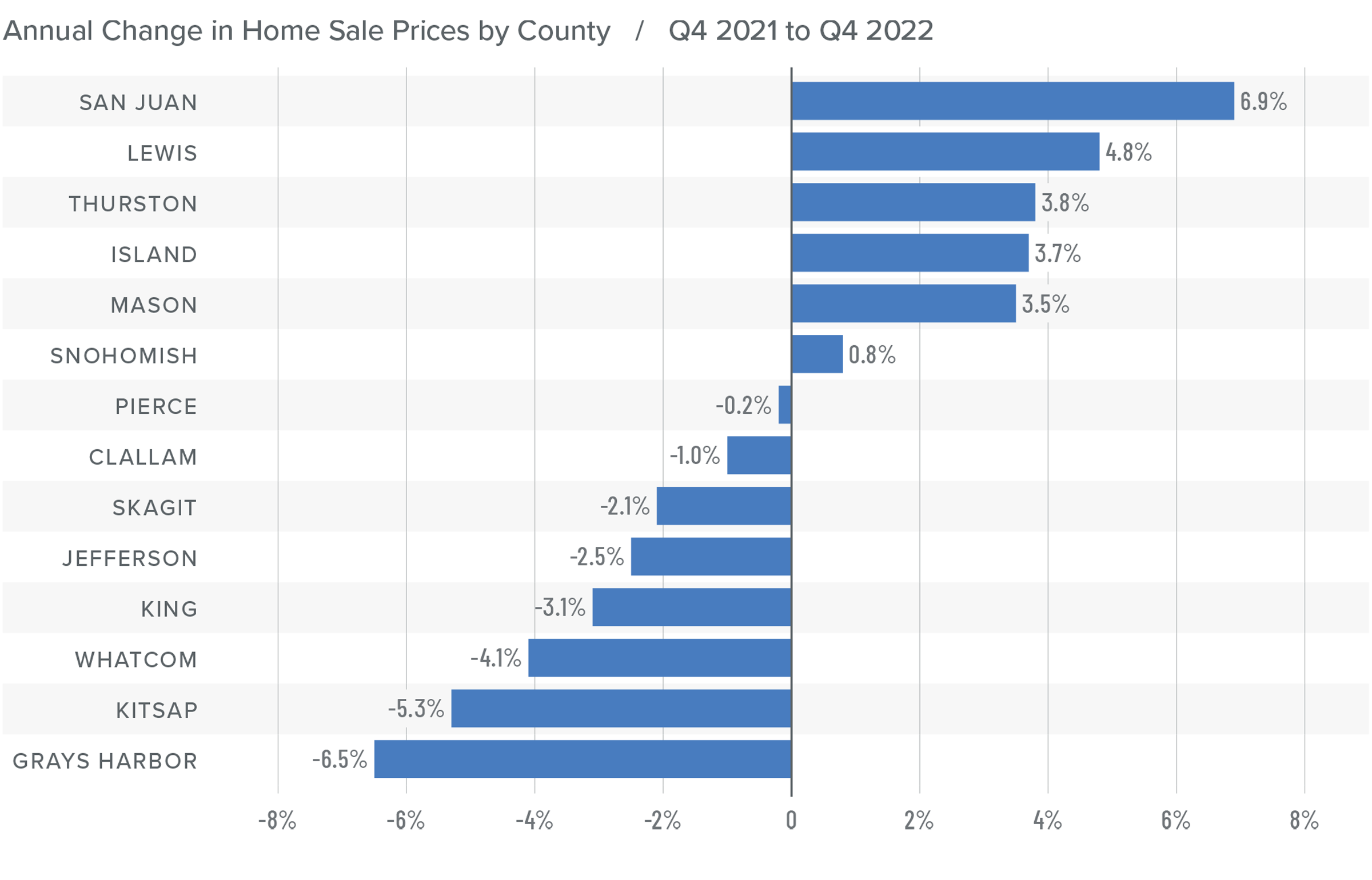

❱ Sale prices fell an average of 2% compared to the same period the year prior and were 6.1% lower than in the third quarter of 2022. The average sale price was $702,653.

❱ The median listing price in the fourth quarter of 2022 was 5% lower than in the third quarter. Only Skagit County experienced higher asking prices. Clearly, sellers are starting to be more realistic about the shift in the market.

❱ Even though the region saw aggregate prices fall, prices rose in six counties year over year.

❱ Much will be said about the drop in prices, but I am not overly concerned. Like most of the country, the Western Washington market went through a period of artificially low borrowing costs, which caused home values to soar. But now prices are trending back to more normalized levels, which I believe is a good thing.

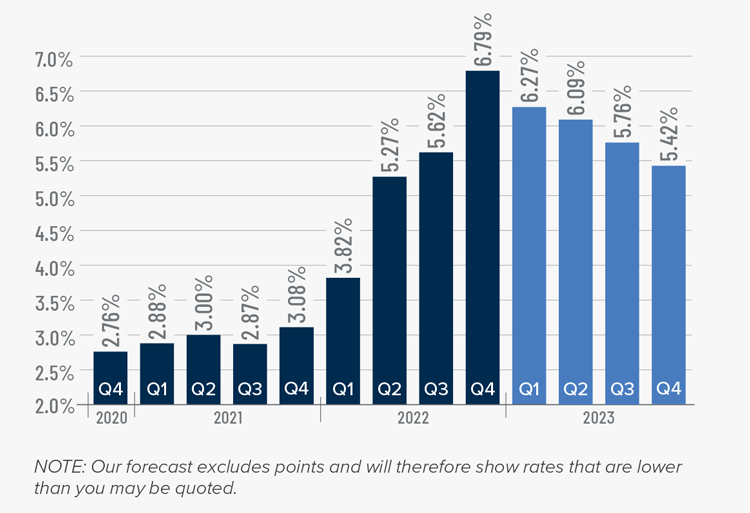

Rates rose dramatically in 2022, but I believe that they have now peaked. Mortgage rates are primarily based on the prices and yields of bonds, and while bonds take cues from several places, they are always impacted by inflation and the economy at large. If inflation continues to fall, as I expect it will, rates will continue to drop.

My current forecast is that mortgage rates will trend lower as we move through the year. While this may be good news for home buyers, rates will still be higher than they have become accustomed to. Even as the cost of borrowing falls, home prices in expensive markets such as Western Washington will probably fall a bit more to compensate for rates that will likely hold above 6% until early summer.

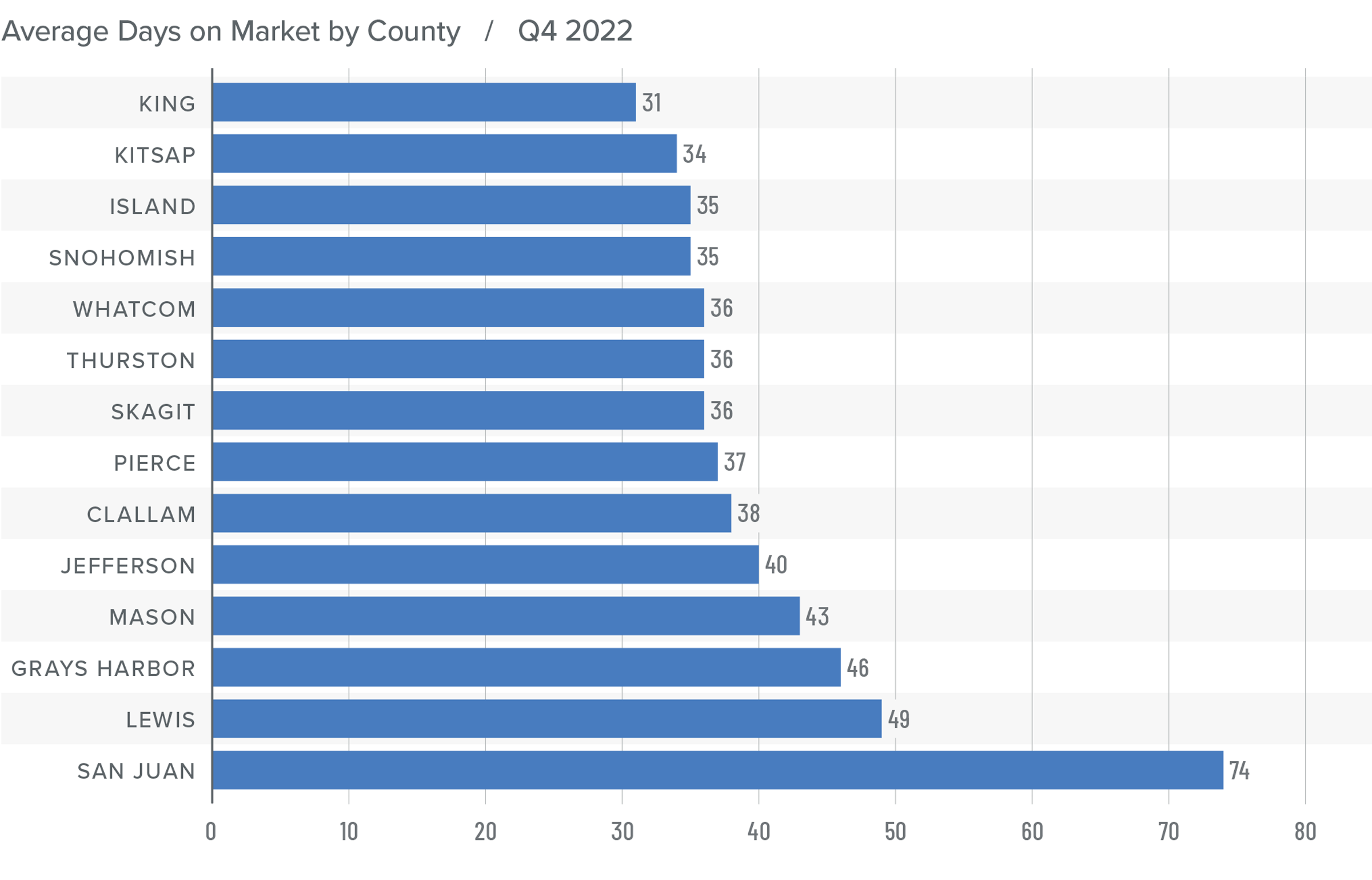

❱ It took an average of 41 days for homes to sell in the fourth quarter of 2022. This was 17 more days than in the same quarter of 2021, and 16 days more than in the third quarter of 2022.

❱ King County was again the tightest market in Western Washington, with homes taking an average of 31 days to find a buyer.

❱ All counties contained in this report saw the average time on market rise from the same period a year ago.

❱ Year over year, the greatest increase in market time was Snohomish County, where it took an average of 23 more days to find a buyer. Compared to the third quarter of 2022, San Juan County saw average market time rise the most (from 34 to 74 days).

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

The regional economy is still growing, but it is showing signs of slowing. Although this is not an immediate concern, if employees start to worry about job security, they may decide to wait before making the decision to buy or sell a home. As we move through the spring I believe the market will be fairly soft, but I would caution buyers who think conditions are completely shifting in their direction. Due to the large number of homeowners who have a mortgage at 3% or lower, I simply don’t believe the market will become oversupplied with inventory, which will keep home values from dropping too significantly.

Ultimately, however, the market will benefit buyers more than sellers, at least for the time being. As such, I have moved the needle as close to the balance line as we have seen in a very long time.

About Matthew Gardner

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

|

|

|

|

|

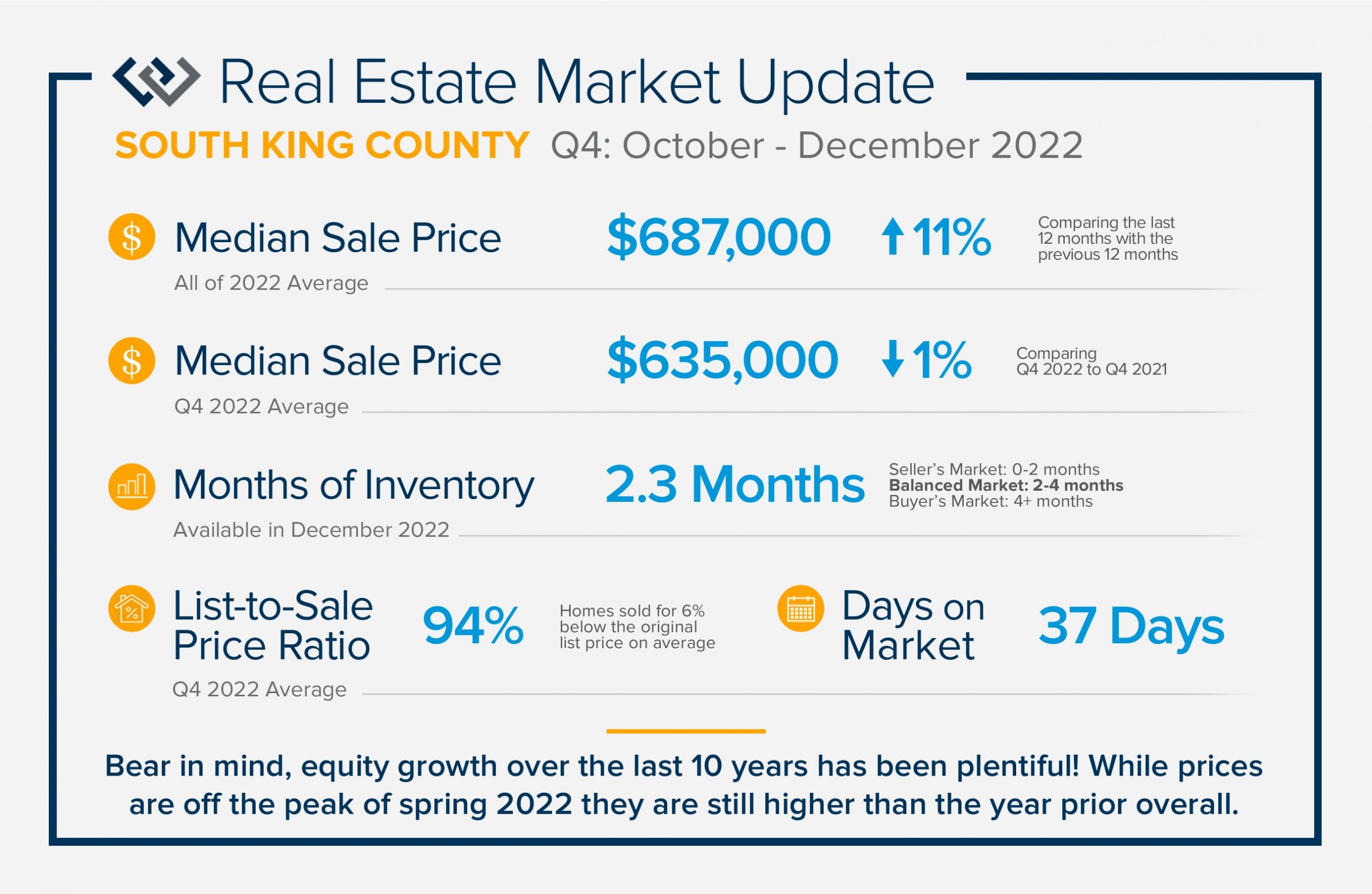

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in balance. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity gr owth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

owth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

Experts anticipate rates to continue to improve throughout 2023 and buyer demand to grow. Buyers that are looking to enter the market should engage now. Price growth may be flat as we adjust to these norms and then should start to maintain historical annual appreciation rates closer to 2-5% year-over-year after years of double-digit annual growth. If you are curious about how the market affects your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

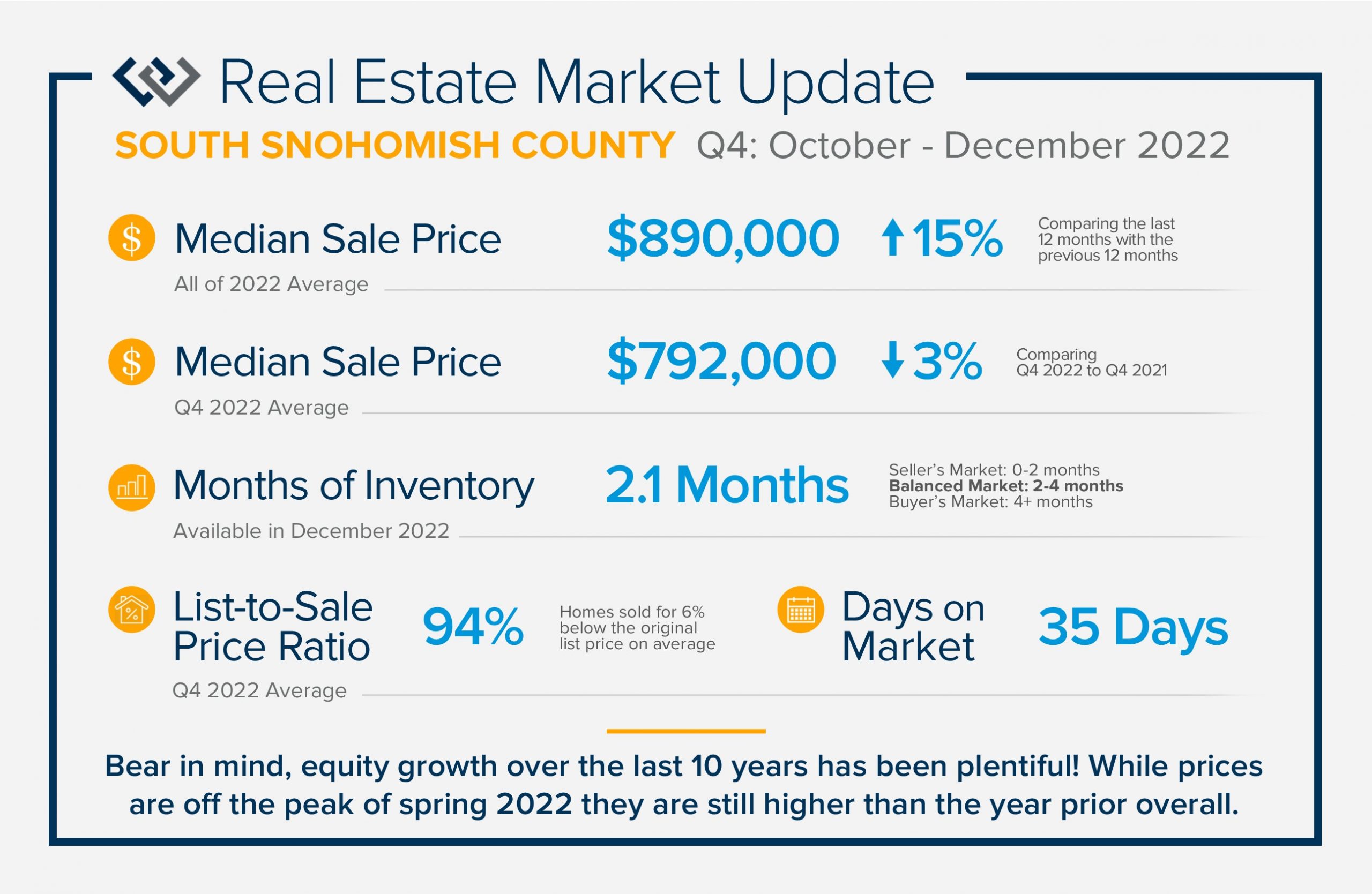

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in  balance. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

balance. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

Experts anticipate rates to continue to improve throughout 2023 and buyer demand to grow. Buyers that are looking to enter the market should engage now. Price growth may be flat as we adjust to these norms and then should start to maintain historical annual appreciation rates closer to 2-5% year-over-year after years of double-digit annual growth. If you are curious about how the market affects your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in ba lance. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

lance. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

Experts anticipate rates to continue to improve throughout 2023 and buyer demand to grow. Buyers that are looking to enter the market should engage now. Price growth may be flat as we adjust to these norms and then should start to maintain historical annual appreciation rates closer to 2-5% year-over-year after years of double-digit annual growth. If you are curious about how the market affects your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in bala nce. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

nce. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

Experts anticipate rates to continue to improve throughout 2023 and buyer demand to grow. Buyers that are looking to enter the market should engage now. Price growth may be flat as we adjust to these norms and then should start to maintain historical annual appreciation rates closer to 2-5% year-over-year after years of double-digit annual growth. If you are curious about how the market affects your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in bala nce. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

nce. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

Experts anticipate rates to continue to improve throughout 2023 and buyer demand to grow. Buyers that are looking to enter the market should engage now. Price growth may be flat as we adjust to these norms and then should start to maintain historical annual appreciation rates closer to 2-5% year-over-year after years of double-digit annual growth. If you are curious about how the market affects your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

2022 was a transitional year for the real estate market that started off incredibly seller-centric and ended in balan ce. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

ce. We started 2022 with interest rates hovering in the low 3%, peaked at 7% in late fall, and ended the year hovering in the mid 6%. This significant jump created a correction in home prices as the cost to finance a home affected affordability. Bear in mind, equity growth over the last 10 years has been plentiful! While prices are off the peak of spring 2022, they are still higher than the year prior overall. 2022 became a more traditional market with interest rates in line with historical averages, more available inventory, and the return of contract contingencies and concessions for buyers. This balance has increased days on market, highlighted the importance of accurate pricing, and made the best-prepared homes shine.

Experts anticipate rates to continue to improve throughout 2023 and buyer demand to grow. Buyers that are looking to enter the market should engage now. Price growth may be flat as we adjust to these norms and then should start to maintain historical annual appreciation rates closer to 2-5% year-over-year after years of double-digit annual growth. If you are curious about how the market affects your housing goals, please reach out. It is my goal to help keep my clients informed and empower strong decisions.

|

|

|

|

|

|

|

|

|

|